Market Overview

When markets are so fretful, the Trump administration playing a game of “will they, won’t they” is not helpful. Whether they have just been blindsided (or whether the blinkers have been on) over Coronavirus, US politicians are yet to agree or have a plan in place for fiscal stimulus. Markets are dealing in rumours and briefings right now. The wild swings in sentiment on Wall Street suggest there needs to be a definitive plan in place from the US Government, and fast. The questions surrounding fiscal support for economies is set to be a theme, with the questions surrounding the prospect of stimulus in the US, the UK Annual Budget announcement is today in Parliament. Support for small businesses and individuals across the UK economy is expected to cope with the economic shock of Coronavirus. The monetary side is also in focus, as this morning the Bank of England has also become the latest in a line of central banks to cut rates. So into today’s session, we see Treasury yields ticking back lower again, the dollar under pressure again and equities also selling down again. How UK assets respond to the Bank of England move will also be interesting. Sterling has initially dropped by around 50 pips against the dollar, so this would suggest the market anticipated the decision, perhaps it was just the timing that has shocked, arguably sooner than anticipated. It gives hope that perhaps the UK Government and Bank of England are collaborating for a dual monetary and fiscal response. FTSE 100 has at least responded well early this morning.

Wall Street closed sharply higher with the S&P 500 +4.9% at 2882, but the wild ride will not stop there as the rollercoaster looks set for another swing lower today with US futures -2.4% currently. Asian markets were broadly lower with the Nikkei -2.3% and Shanghai Composite -0.9%. European markets look tentatively positive in early moves. In forex, renewed USD selling has taken hold, but GBP underperformance is greater moving into the European session. JPY and NZD are the main outperformers. In commodities, with the dollar weaker and yields lower, we see gold rebounding once more by +0.8%. Oil has begun to generate some renewed negative pressure.

US inflation will be the main distraction for the economic calendar, but there is a smattering of UK data first up. The UK monthly GDP for January is at 0930GMT and is expected to show a decent showing of +0.2% (after +0.3% in December). UK Industrial Production is expected to show growth of +0.3% in the month of January, but this would take the Year on Year decline down to -2.6% (from -1.8% in December). The UK Trade Balance is expected to show a deficit of -£7.0bn in January (after the surprise surplus of +£0.8bn in December). The main focus for the day will be US inflation, with US CPI at 1230GMT. Headline CPI is expected to show 0.0% growth in February which would drag the year on year CPI down to +2.2% (from +2.5% in January). Core CPI is expected to grow by +0.2% which would maintain the year on year core CPI at +2.3% (+2.3% in January).

There are no central bankers due to speak today, with FOMC members in the blackout period until next Wednesday’s meeting.

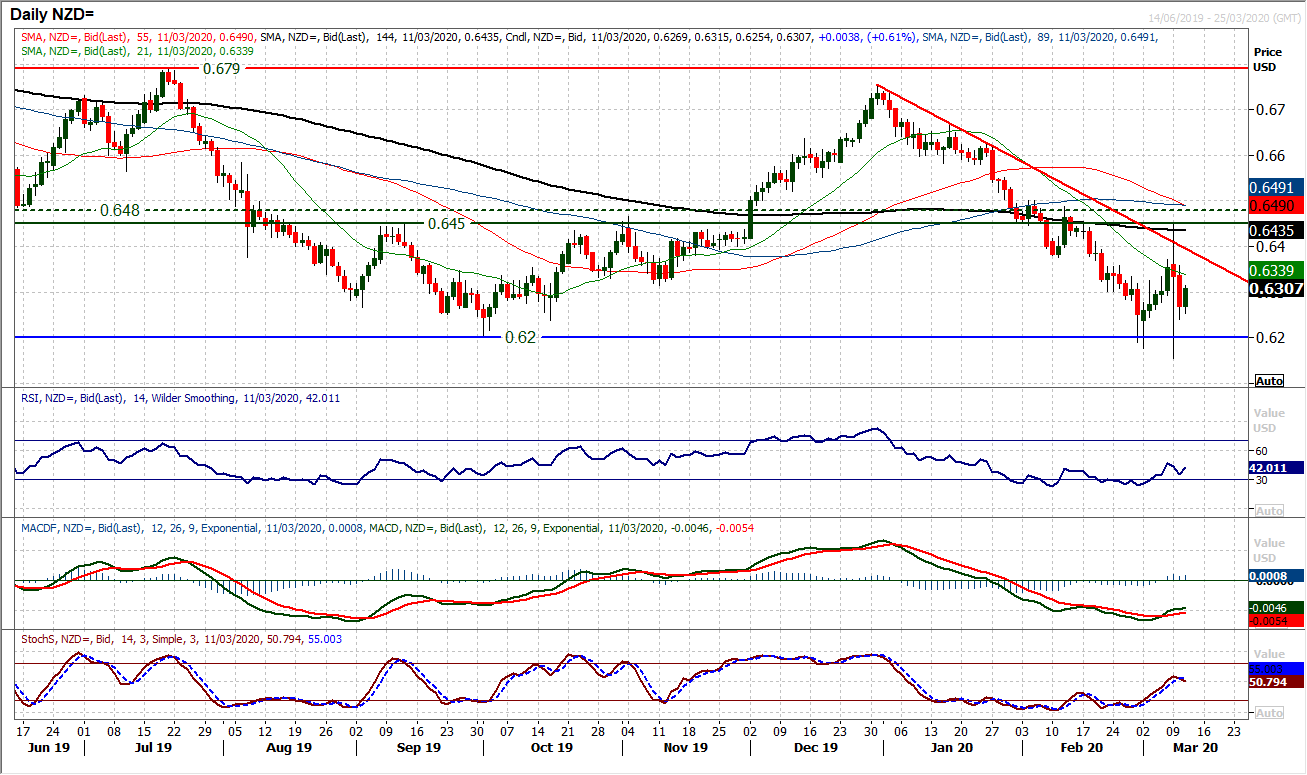

Chart of the Day – NZD/USD

Attempting to make sense of the charts of commodity currencies is a massively difficult task right now. With incredible levels of volatility seen in Monday’s session, the technical rally of late February seems to have been turned on its head. Trying to look past the huge intraday swing, with a renewed negative candle yesterday and two consecutive bear closes, it seems that the strength of the dollar and move away from a higher risk Kiwi is now looking to resume. Near term rallies such as that early today look to be a chance to sell. Essentially, the ten week downtrend is still playing out and the early March rally has helped to renew downside potential. The pair could now be set for another bear leg lower. The RSI and Stochastics have effectively just unwound to fall over around neutral again (bear cross on Stochastics), whilst the MACD lines have barely even got going in a recovery. As such, we expect the market is looking back towards another test of the support around $0.6200 again. The hourly chart shows resistance building at $0.6330/$0.6360. A move back below the near term pivot at $0.6280 (which has consistently been a turning point in recent weeks) would open the lows around $0.6150/$0.6200.

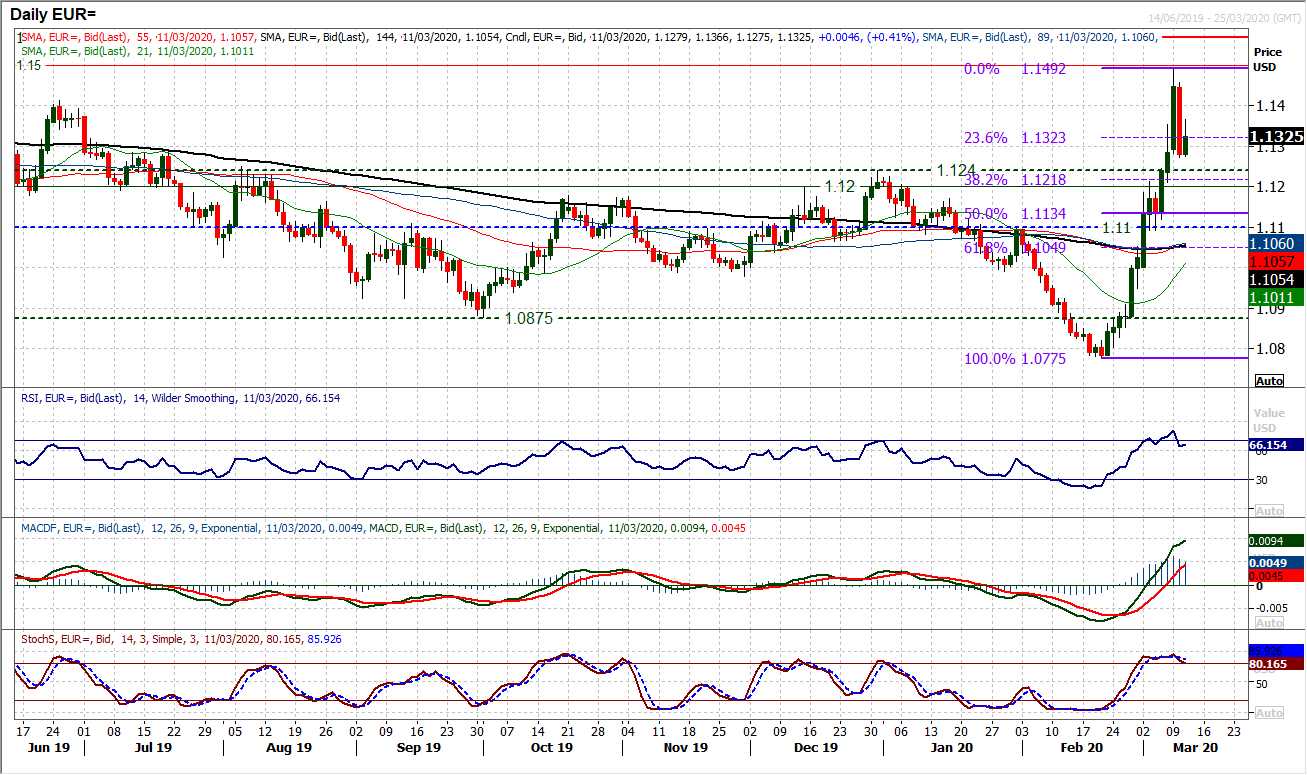

EUR/USD

The huge negative candle of yesterday’s session acted entirely to counterbalance a huge positive candlestick from Friday. These wild swings on EUR/USD just go to show how difficult trading has become. The Average True Range is now 117 pips, which is incredible for a pair usually as stable as EUR/USD. We are not done there yet though, as renewed concern over the deliverability of US fiscal stimulus has pulled yields lower and the dollar is back under pressure. Another swing back higher on EUR/USD is underway today. On a technical basis, there has been a cross of the RSI back under 70 (from the closing peak of over 80 on Friday). This is potentially a corrective move, but given the volatility, looking for confirmation below 60 would be wise before enacting any negative outlook. The Stochastics have also not confirmed anything negative yet either. This morning, the market has picked up from $1.1275 which now becomes a basis of support. The hourly chart shows a potential corrective move would also be scuppered on a move back above $1.1400. How the dollar bulls react to this renewed negative pressure will be interesting now, as it had looked that they were beginning to reclaim some control. A failure of this rebound back under $1.1325 (around the 23.6% Fibonacci retracement of the $1.0775/$1.1492 rally) would be negative now. We have entered an interesting crossroads phase.

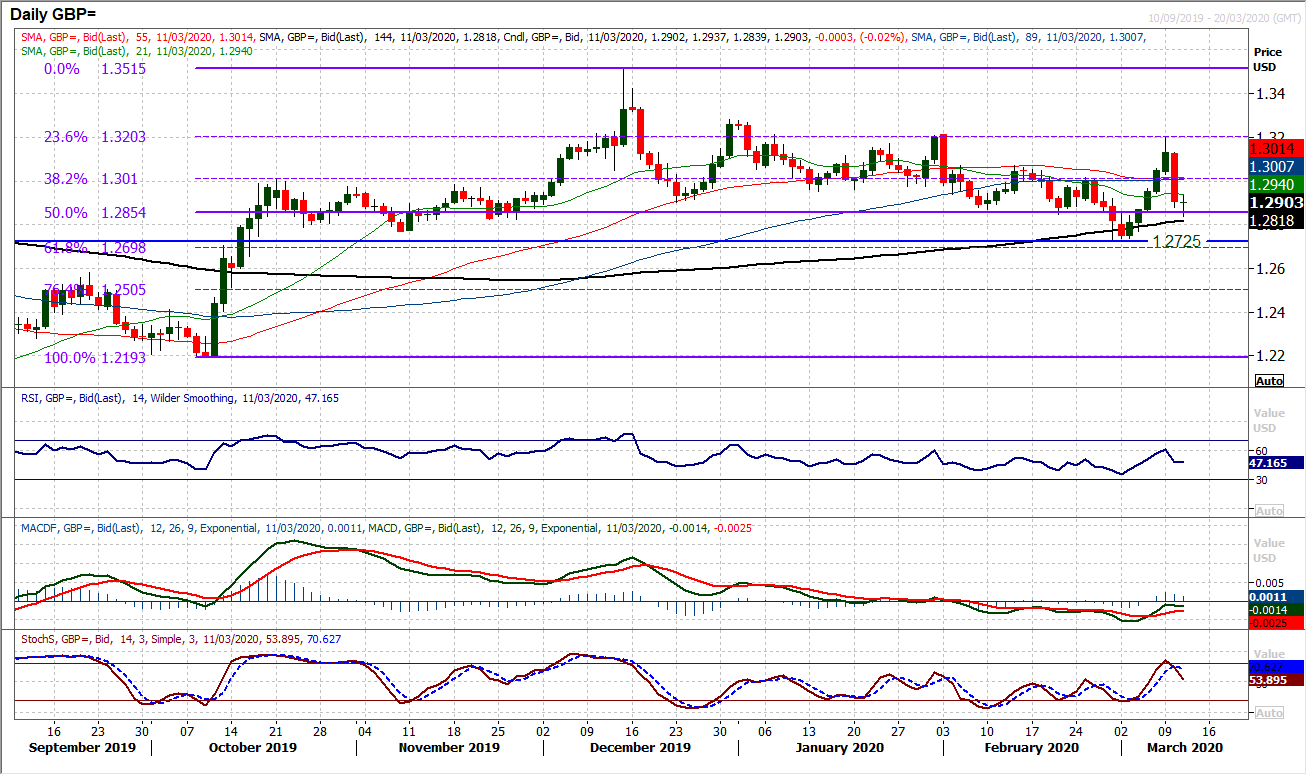

GBP/USD

A dollar recovery has once more turned Cable around after a five day bull run. It is incredible to see that even amidst the volatility that has so enormously ramped up recently, there is still a tendency for Cable to trend for a handful of days in one direction and then retrace once more. The strong negative candlestick which has closed the market back below $1.3000 once more, renewed the negative bias and re-opens the pressure on the 50% Fibonacci retracement (of $1.2193/$1.3515) at $1.2855. On so many occasions has Cable used these Fib levels, that closing decisively below the 38.2% Fib (at $1.3010) is a key move. Momentum indicators turning lower with the RSI falling back under 50 (from a failure at 60) along with a Stochastics bear cross has given the chart a negative bias. The Cable bulls dragged the market higher overnight, but in no meaningful manner even before the Bank of England rate cut renewed negative pressure on Cable. So, with the negative legacy of yesterday’s session still a hangover, we look for any intraday or near term rallies towards $1.3000 to fade for pressure back towards $1.2855. A closing breach of the 50% Fib level (at $1.2855) would re-open $1.2725 again.

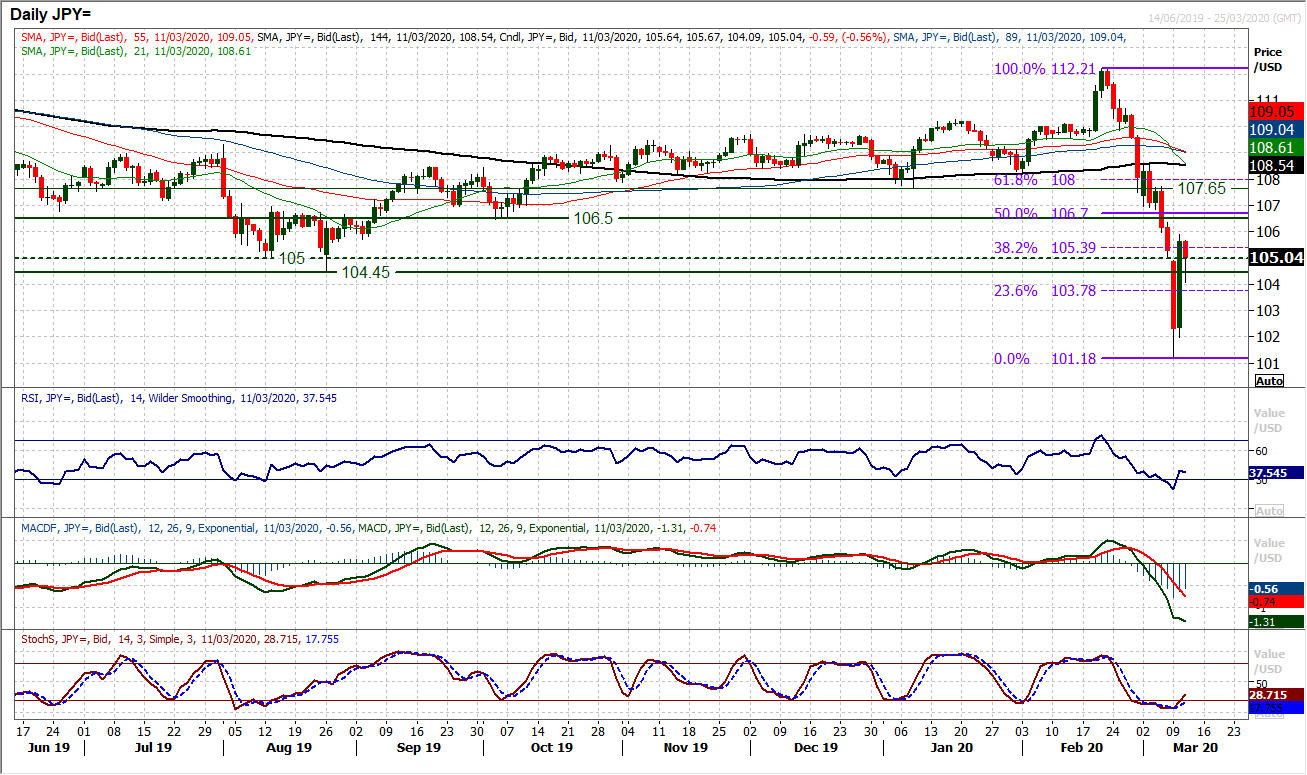

USD/JPY

With such elevated levels of volatility, there are some pretty wild charts amongst the forex majors right now, but Dollar/Yen is one of the wildest. A huge rally yesterday added +330 pips. However, not done there yet, Dollar/Yen has swung massively back lower again this morning. The question is how the bulls are now going to respond to renewed selling pressure. On a technical basis, the foundations of a recovery are forming, with crossover buy signals on daily RSI and Stochastics developing (Stochastics yet to confirm) and more positive configuration on the hourly chart. The important support is at 103.20 which was a higher low yesterday that needs to hold to sustain the concept of recovery. The bulls will also be eyeing the 23.6% Fibonacci retracement (of 112.20/101.18) around 103.80 to be a basis of support if recovery is truly on the cards. The market has pulled back from 105.90 today leaving this as resistance now.

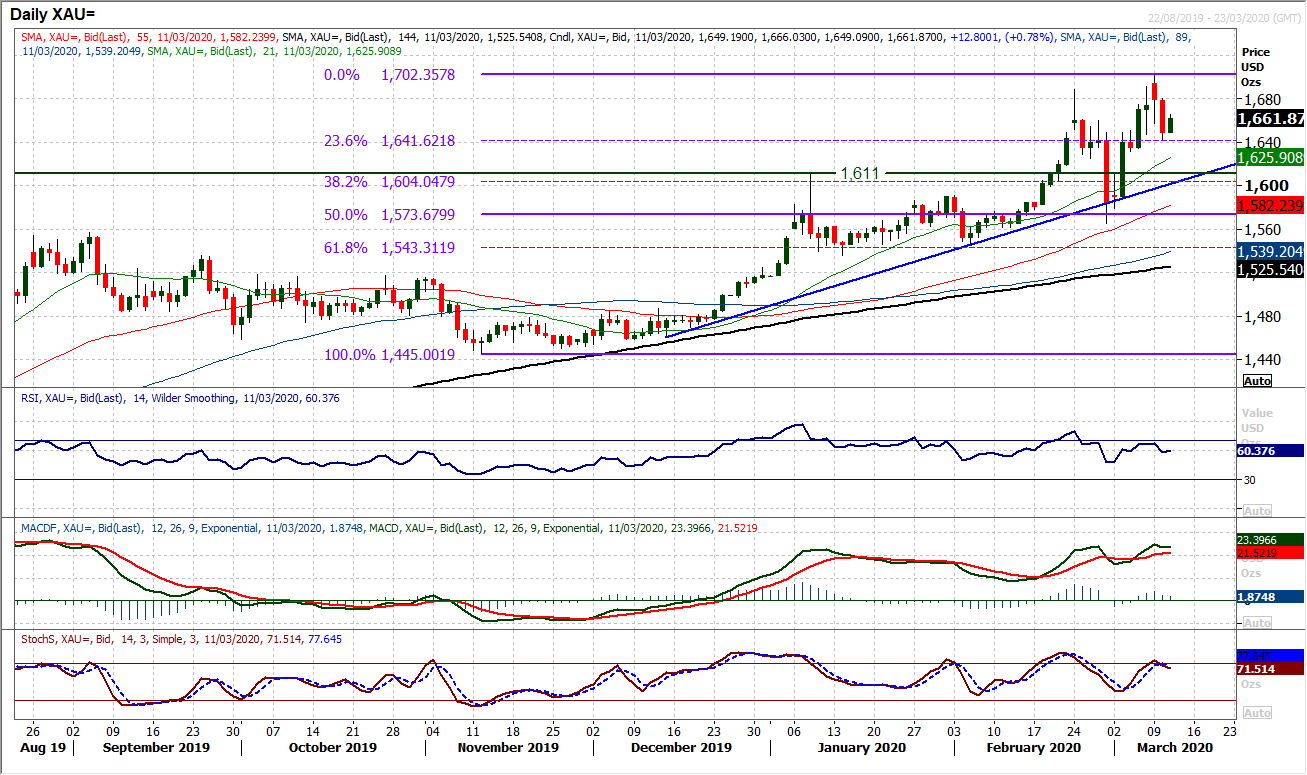

Gold

We have been discussing the prospect of a near term gold corrective move in recent sessions. On a technical basis, a couple of negative candles in a row (even if Monday’s closing price was higher) has threatened this. Some interesting developments have occurred in the past 24 hours. Firstly a small top pattern completed below a pivot around $1660 which implies a target of around -$40. This rolling over has also posted a bear cross on Stochastics, whilst MACD lines and RSI have also lost impetus. We continue to see near term pullbacks within what is now a three month uptrend, as being a chance to buy. The market has though (positively) already found support around the 23.6% Fibonacci retracement (of $1445/$1702) at $1641. The near term outlook is subsequently mixed. It would turn positive again above a lower high of $1680, whilst closing decisively back under $1660 leaves the corrective momentum in place. Below $1641 the target of $1620 resumes as a target.

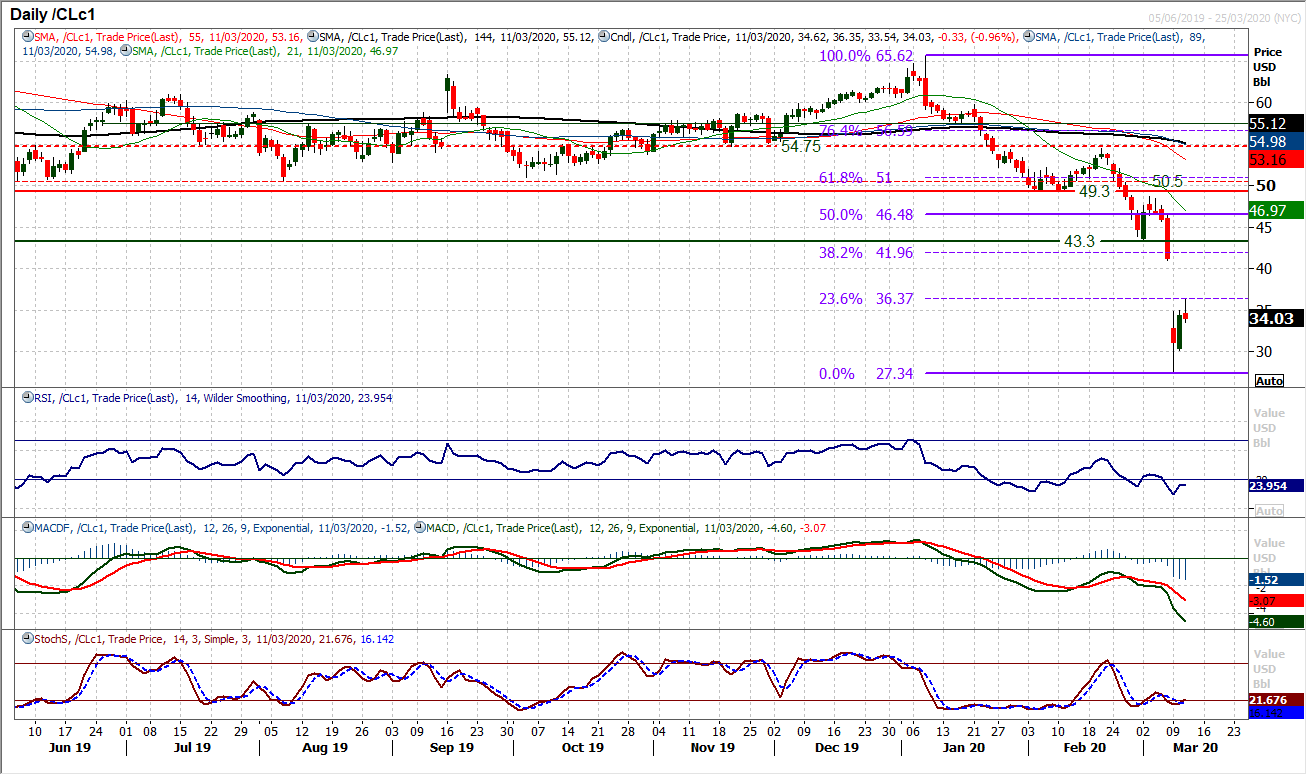

WTI Oil

There is a long way to go in a recovery but at least a first positive candle has been posted. In the broader context of the decline, incredibly, a rebound of 10% has barely scratched the surface. However, at least the bulls are looking to regather themselves. For now, momentum remains deeply oversold so there is still the prospect of a retracement. However, overnight, the 23.6% Fibonacci retracement (of $65.62/$27.34) has been used as a basis of resistance around $36.35. The hourly chart is looking more orderly, with a succession of intraday higher lows, so $33.55 needs to now hold for the recovery to continue. The bulls will be looking to overcome $36.35 to sustain the momentum of the move higher, with the massive gap at $41.05 still open as a cavernous hole in the chart.

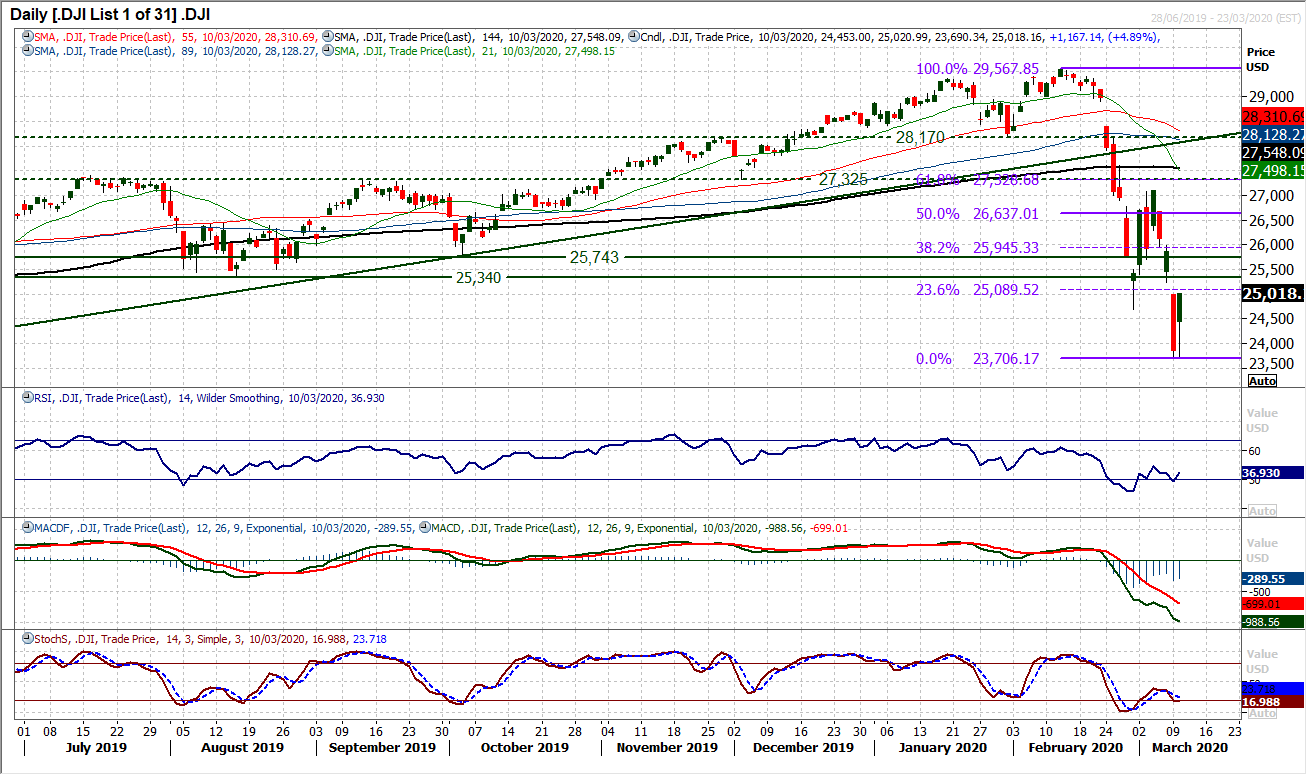

Dow Jones Industrial Average

Incredible intraday swings saw the Dow close almost 5% higher last night. However, those swings of volatility have continued with futures currently showing US futures between -2%/-3% back lower again. Making a reasonable analysis of the Dow is an impossibility right now, with sentiment swinging so wildly even on an intraday basis. On a technical basis, there are now hints of positive divergences on RSI and Stochastics to watch out for, but to see these through to completion, there would need to be a run of two or three positive candles at least. With futures looking hairy again today, this seems unlikely. It would be nice to say with confidence that a bottom has been reached, but again yesterday’s low at 23,690 which is over -5% lower, could even be retested again today. The boat is rocking one way and then the other, with no let-up in sight. Resistance will now be yesterday’s high (and all but close) at 25,020.