Market Overview

Sentiment continues to improve as equity markets climb on the confidence given to them that the COVID-19 treatment drug from Gilead could allow economies to battle through whilst a vaccination is still being developed. The Federal Reserve painted a dour picture of the US economy in a meeting that left all of its policy tools somewhat open-ended. Although there was no talk of further potential policy actions (such as yield curve control), the dollar remains on its recent corrective path. Equities reacted with initial caution to the Fed, but are again looking to push forward today as the European session takes hold. With bond yields just holding ground, there is a degree of consolidation on forex major markets this morning. Having got through the FOMC meeting, the ECB is a now the key focus for traders. However, we are not expecting too many fireworks from the ECB either. Staff forecasts are updated for the June meeting, whilst the major impact of COVID-19 on the Eurozone will be felt in the April data which will not be known for a few weeks. ECB President Lagarde has managed to recovery from a very rocky start to her tenure, and is likely to try and do her best Mario Draghi impression by stressing the central bank will do whatever it takes to protect the Eurozone economy and the stability of the euro. Right now, having already announced the €750bn Pandemic Emergency Purchase Programme, with sovereign yield spreads fairly manageable, it will be interesting to see if Lagarde does any more than stern rhetoric. Chinese data was a bit mixed overnight, although there are signs of stabilisation. China’s Manufacturing PMI (the official one) came in at 50.8, whilst Non-Manufacturing PMI (official services) were 53.2, both showing activity in April expanded slightly on that of March and the Composite PMI improved slightly to 53.4. The unofficial Caixin PMI data showed manufacturing contracted slightly at 49.4.

Wall Street closed with strong gains last night with the S&P 500 +2.7% higher at 2939. With futures pushing marginally ahead again (E-mini S&Ps +0.4%) there is a sense of stability into today. Asian markets reacted strongly overnight, with the Nikkei +2.1% and Shanghai Composite +1.4%. European markets also look decently set up for today with FTSE futures +0.5% and DAX futures +0.9%. In forex, there is a consolidation with a mixed look to USD. EUR is consolidating ahead of the ECB, but JPY remains positive, whilst AUD and NZD are consolidating their recent gains. In commodities, we see mixed moves on gold and silver, whilst the big rebounds continue on oil, with WTI c. +10% and Brent Crude +6%.

There is a keen European focus for much of the first half of today’s economic calendar. The Eurozone flash inflation for April is at 1000BST and is expected to show headline HICP declining sharply to be rising by just +0.1% (down from +0.7% in March), with core HICP falling back to +0.7% (from +1.0%). Prelim Eurozone GDP for Q1 is also at 1000BST and is expected to decline by -3.5% on the quarter (after just +0.1% growth in the final Q4 2019 reading). Eurozone Unemployment is at 1000BST and is also expected to increase to 7.7% in March (up from 7.3% in February). The key focus of the day though comes with the ECB monetary policy, with the announcement at 1245BST (no change expected to the main refinancing rate of 0.0% or the deposit rate of -0.50%. ECB President Lagarde’s press conference at 1330BST will be worth watching for the usual “whatever it takes” type of speech. The US data will also be interesting, with core Personal Consumption Expenditure for March is at 1330BST expected to show a -0.1% decline on the month, pulling yearly inflation back to +1.6% (from +1.8% in February). US Weekly jobless Claims are at 1330BST and are expected to show another 3.500m claims (although this is down from 4.427m last week)

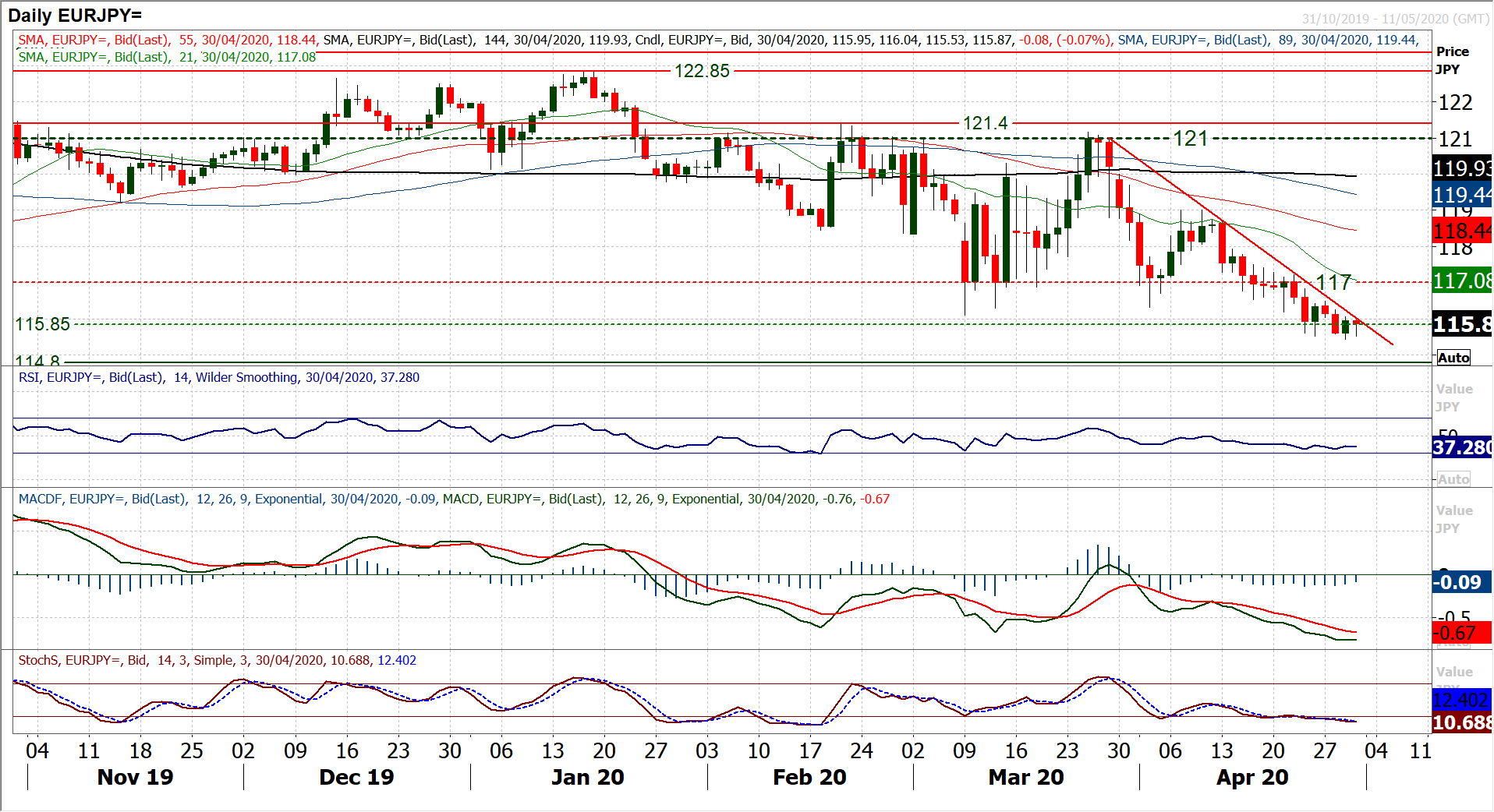

Chart of the Day – EUR/JPY

The euro may have managed to claw back some losses against the dollar recently, but crossed with the yen, it is a whole different story. The selling pressure continues. Last week, we discussed about the market testing key support at 115.85. We now see that with Tuesdays decisive negative candle closing below the support, there has been a key downside break to a three year low. This opens the downside once more. The continuation of what is now a five week downtrend, suggests that rallies are a chance to sell, with the trend falling as resistance at 116.00 today. This is reflected in the momentum indicators which are all negatively configured whilst the RSI still shows further downside potential. We are sellers into strength now, with near term resistance 115.85/116.50 as a near term sell-zone. The bears will be in control until the resistance at 117.20 is breached. Once more we see that yesterday’s bounce has been seen today as another chance to sell. Clearing 115.85, the next support is not until 114.80 (the April 2017 low) with a retreat towards 112.00 a very real possibility in due course. Initial support at 115.45 from yesterday’s low.

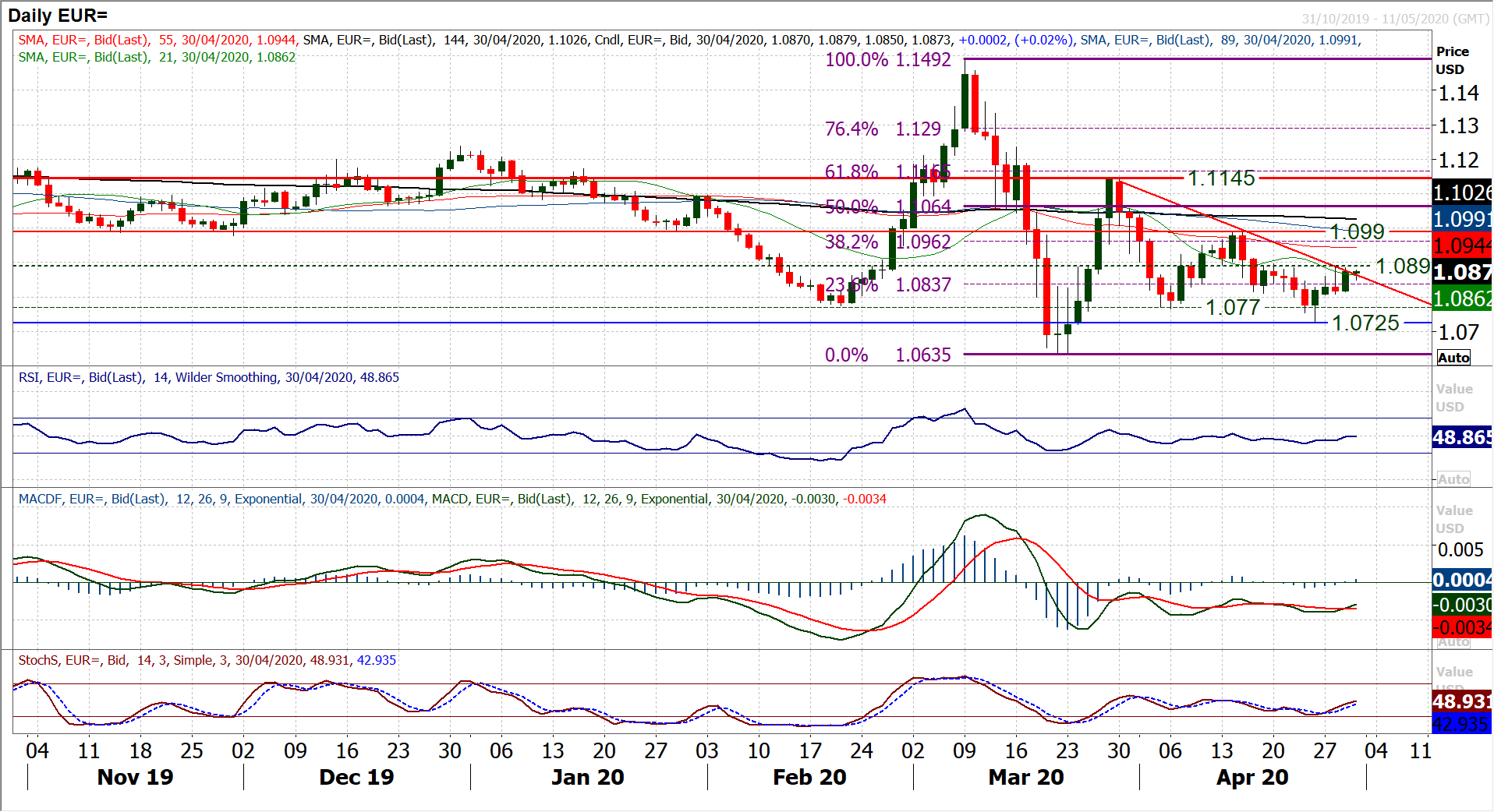

EUR/USD

There is still a near term recovery on EUR/USD playing out as the dollar has turned corrective in recent sessions. However, for now, this still seems to be counter to a continued negative outlook for the pair. Trading below a clutch of falling moving averages, and below a near five week corrective downtrend, rallies appear to be a chance to sell. The strength of conviction in this outlook is though wavering this morning as the market consolidates after a third positive candle in the past four sessions. This is testing the stability of the downtrend that falls at $1.0865 today. The near term outlook remains dominated by the increasingly important pivot resistance at 108.90 which has grown as resistance in the last two weeks. A continued failure of this rally under the pivot will re-establish the broader negative outlook on EUR/USD, especially if the support at $1.0810 is broken once more. Momentum has ticked higher with the recent rebound, but we still see this as part of an ongoing negative medium term bias. This outlook would need to be re-evaluated on a decisive close above $1.0890. The ECB adds a degree of uncertainty to the outlook early today and we will know much more about how far this rally can progress later today. Initial support at $1.0840 will be an early gauge.

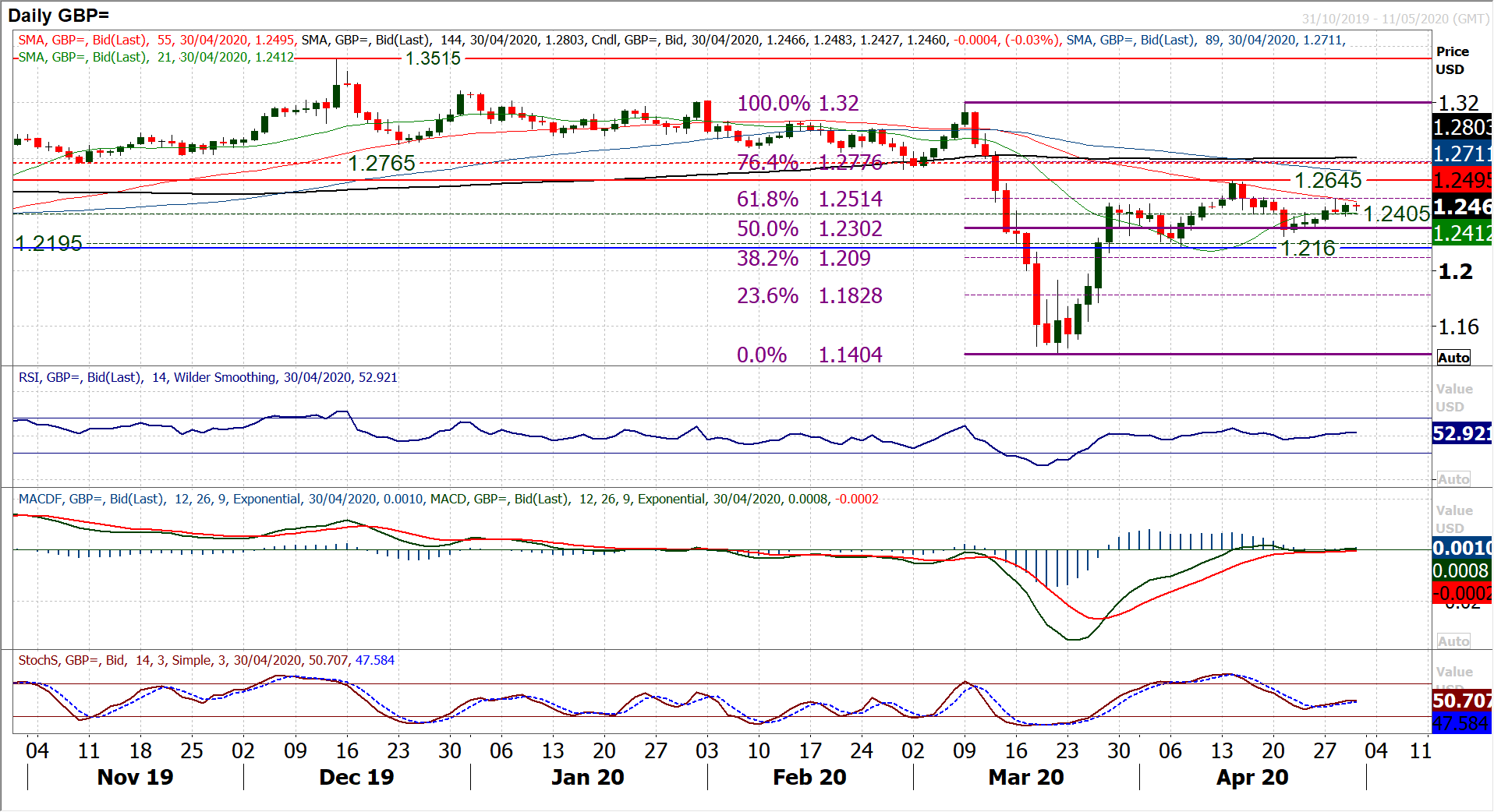

GBP/USD

After a disappointing session on Tuesday, the Cable bulls dusted themselves down and looked to go again yesterday, as the recent drift rally remains on track. We have identified this as a range play that has formed over the past month. The basis of this range is support at $1.2160 and resistance at $1.2645. Within that there seems to be a growing mid-point pivot which is loosely around the $1.2400 area (yesterday’s low picked up from $1.2385). Trading above this pivot lends a mild positive bias, something that is backed by the momentum indicators tentatively edging positively above their neutral points. However, the resistance of the 61.8% Fibonacci retracement (of $1.3200/$1.1405) is growing at $1.2515 (which was also Tuesday’s bull failure high). How the market reacts as it approaches this resistance, possibly today, will be an important gauge as to whether this really is a range. If so, then another bull failure will turn lower around the Fib level and we will see a continuation of consolidation between the 50% and 61.8% Fibs. An upside break though would open the key April high of $1.2645 again, with the prospect that this could be a recovery trend channel instead. Near term support in the range $1.2385/$1.2425 is building as a base for the bulls.

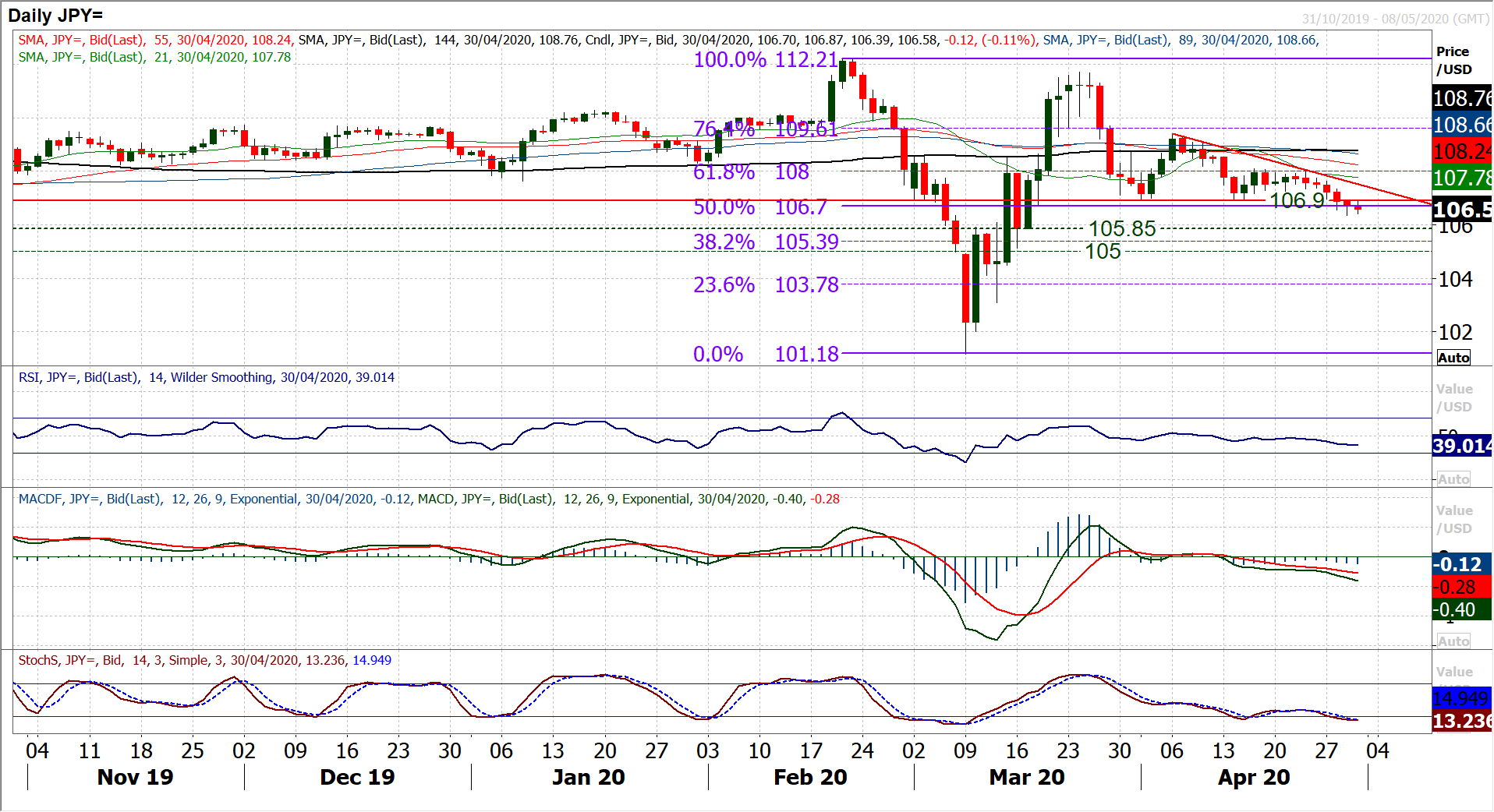

USD/JPY

The outlook remains under growing negative pressure following the decisive downside break of 106.90 support. This old support has now become a basis of resistance. The move has been consistently trading clear of the 50% Fibonacci retracement (of 112.20/101.20) at 106.70 but just failing into the close in the last two sessions. However a decisive closing breach of 106.70 would really now open 38.2% Fib at 105.40 as the next potential target area. There are also some old pivots and lows around 105.85 and 105.00 in this region, so this seems to be a realistic target area now. Momentum is increasingly building to the downside too, with RSI confirming the breakdown, below 40; whilst MACD and Stochastics also grow increasingly bearish. We look to use near term strength as a chance to sell now, with 106.90 as an area of key overhead supply and forming as resistance in the past two sessions. The hourly chart also shows that 107.25/107.35 also remains an area of overhead supply near term. Below yesterday’s low at 106.35 continues the run of lower highs and lower lows.

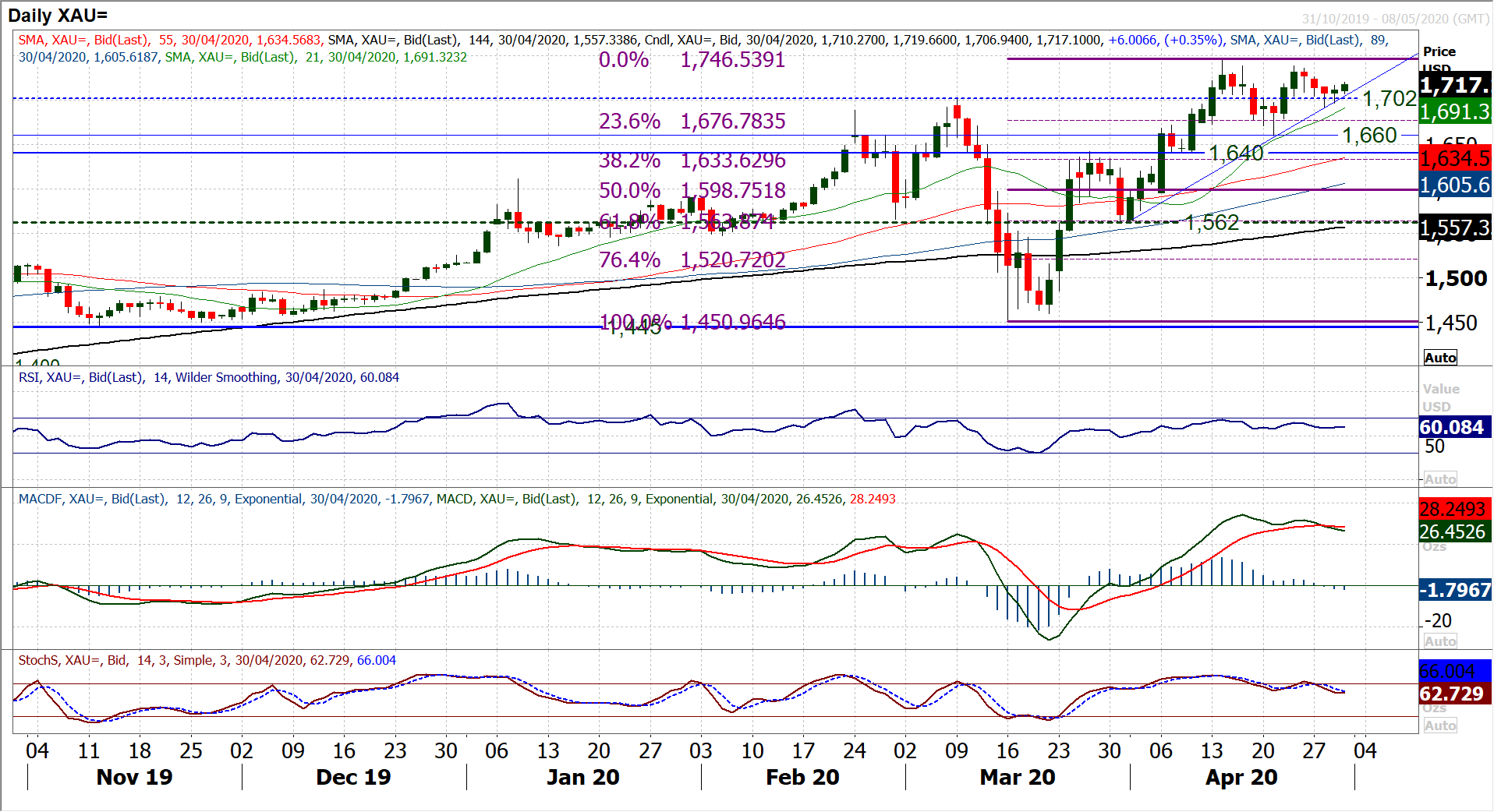

Gold

With the run of three negative candles on gold, we reviewed our near term positive outlook on gold. Taking a more cautious view, we have just taken a step back to see how this phase develops. The pivot at $1702, the old March key high which has in recent weeks become a gauge for the near term outlook, remains an important technical signal. Despite the intraday breaches of this support in the past two sessions, gold is holding above the pivot into the close. This suggests that whilst caution is still wise at this stage, as the consolidation is building, the bulls are tentatively looking to regain control again. We feel happy to be cautious still (especially around the Fed meeting last night, but also today’s ECB decision), but the bulls are beginning to threaten once more. The hourly chart shows the market testing a higher near term pivot at $1718 with increasingly positive configuration on hourly MACD and Stochastics. The market is also now beginning to consistently trade clear above the $1702 pivot once more and leaving the support of Tuesday’s low around $1691 behind. A decisive move above $1718 opens the resistance at $1738 before the recent high of $1746 can be considered.

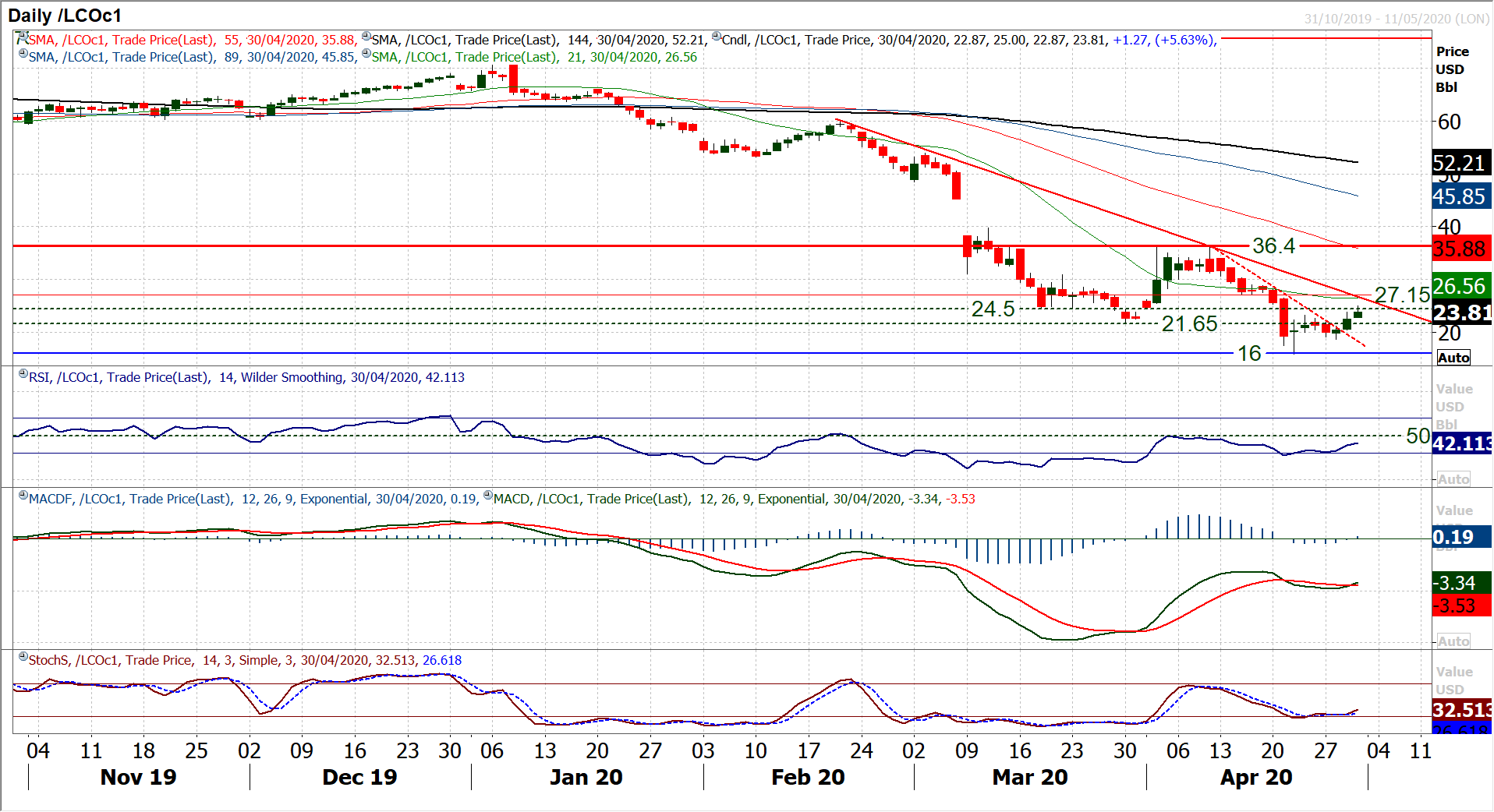

Brent Crude Oil

There has been a considerable positive reaction in the past couple of sessions which is threatening now to change the near to medium term outlook on oil. The demand outlook for oil could be changed by the development of a COVID-19 treatment drug and oil has reacted positively to this prospect. Brent Crude completed a +10% gain yesterday and is showing similar strength today. This has taken the price above the initial resistance band $21.65/$24.50 which were the old lows of March. The improvement is showing through on momentum now, with Stochastics and MACD lines both crossing higher. There are key signals ahead for this recovery now. The downtrend of the big move lower since February comes in at $26.75 today. Furthermore, all of the big near term recoveries (from February and early April) since January have all seen the RSI falter around 50 before the bigger medium term negative outlook has kicked in. For a more considerable recovery to be considered sustainable, a move above 50 on the RSI needs to be maintained. The next resistance of note is between $27.15/$29.00. Initial support is now at the near term breakout $22.00/$23.20.

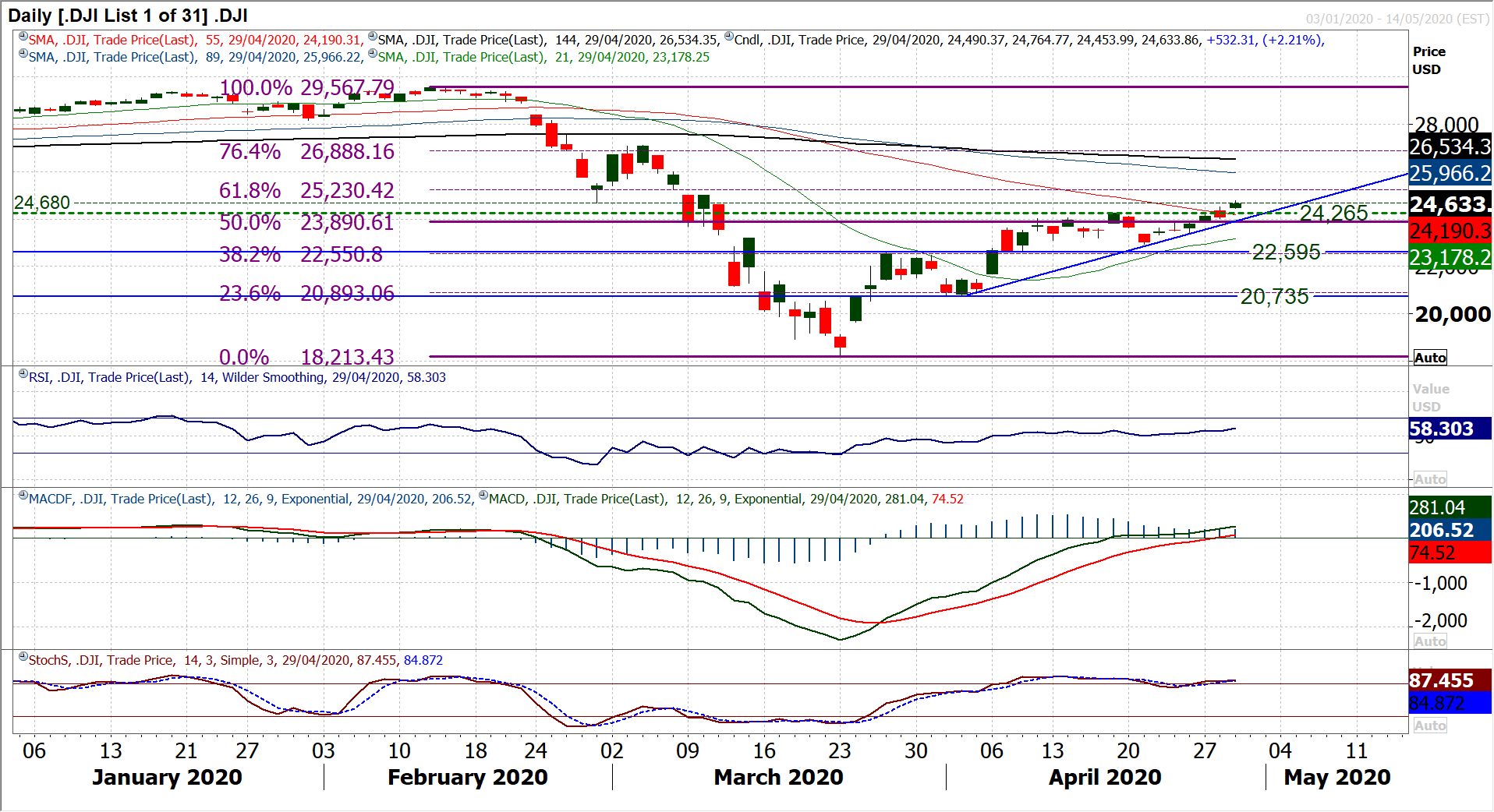

Dow Jones Industrial Average

Despite the dour economic backdrop which was set out yesterday by the Federal Reserve, Wall Street continues to climb. Another decisive positive session from the Dow has seen the market closing at seven week highs and well clear of previous resistance at 24,265. A minor resistance at 24,680 needs to now be negotiated, but essentially pulling decisively clear above the 50% Fibonacci retracement of the big sell-off (from 29,567/18,213) at 23,890 now opens the 61.8% Fib at 25,230 as the next target area. Momentum is with the breakout too, as RSI confirms the breakout at ten week highs, whilst MACD lines are also now climbing above neutral. There is an uptrend of the past four weeks that is supportive at 24,100 today. We continue to look for supported weakness to be a chance to buy once more to continue the recovery.