Market Overview

The sell-off of risk assets is ramping up. With Wall Street over -4% lower last night, the Dow saw its largest points decline since 2008. The futures for today’s session, show that the selling pressure has not abated quite yet either. Fear continues to spread through markets. The VIX Index of S&P 500 options volatility has spiked to its highest level since January 2018. The flood gates have also opened on US Treasury yields, which is seeing the US 10 year yield plunging to all-time lows. The safety of US debt is the place to be right now. One interesting casualty right now has been the US dollar. It has been a strong haven of safety in recent weeks, but as cases of Coronavirus pop up in the US now, the fear is that the negative economic impact is knocking at Uncle Sam’s door. Last week, it was the yen that took the hit from fears over a Japanese economy, this week it is the dollar’s turn to be sold. There has been a massive shift in expectation of a Fed rate cut which has dragged on the dollar. However, we see this as a near term knee jerk move that is unlikely to last. Although the US 10 year yield has fallen -40 basis points in the past two weeks, with such elevated volatility, moves on rate differentials are quickly being priced in. The question is how far markets go before the elastic snaps back? We are seeing extreme technical positions forming on Wall Street now (elevated volume indicates panic selling). Could we be close to a near term technical rally? For now, the selling pressure continues.

Wall Street closed a huge session of losses with the S&P 500 -4.4% lower at 2978. With US Futures another -0.6% lower today, there is a spread of selling across global markets again this morning. Asian markets were broadly slammed with Nikkei -3.6% and Shanghai Composite -3.7%. In Europe, the sell-off also extends with FTSE futures -3.0% and DAX futures -3.3% (even if these levels are off earlier lows). In forex, there is a continuation of JPY outperformance and sizable risk-off positioning with AUD and NZD significant underperformance. It is interesting to see USD beginning to stabilise against EUR and pulling Cable lower. In commodities, there is a big decline forming through gold (-1.0%) as volatility continues, and oil is another -2.5% lower.

It is a day of inflation on the economic calendar. German Prelim HICP for February is throughout the morning, with the countrywide data at 1300GMT which is expected to remain at +1.6% (+1.6% in January). Then the Fed’s preferred inflation gauge, the core Personal Consumption Expenditure for January is at 1330GMT which is expected to grow by +0.2% on the month which would increase the year on year reading to +1.7% (from +1.6% in December).

There are no Fed speakers today, but a couple of Bank of England MPC members that will be worth looking out for today, as Andy Haldane (at 1115GMT) and Jon Cunliffe at 1615GMT.

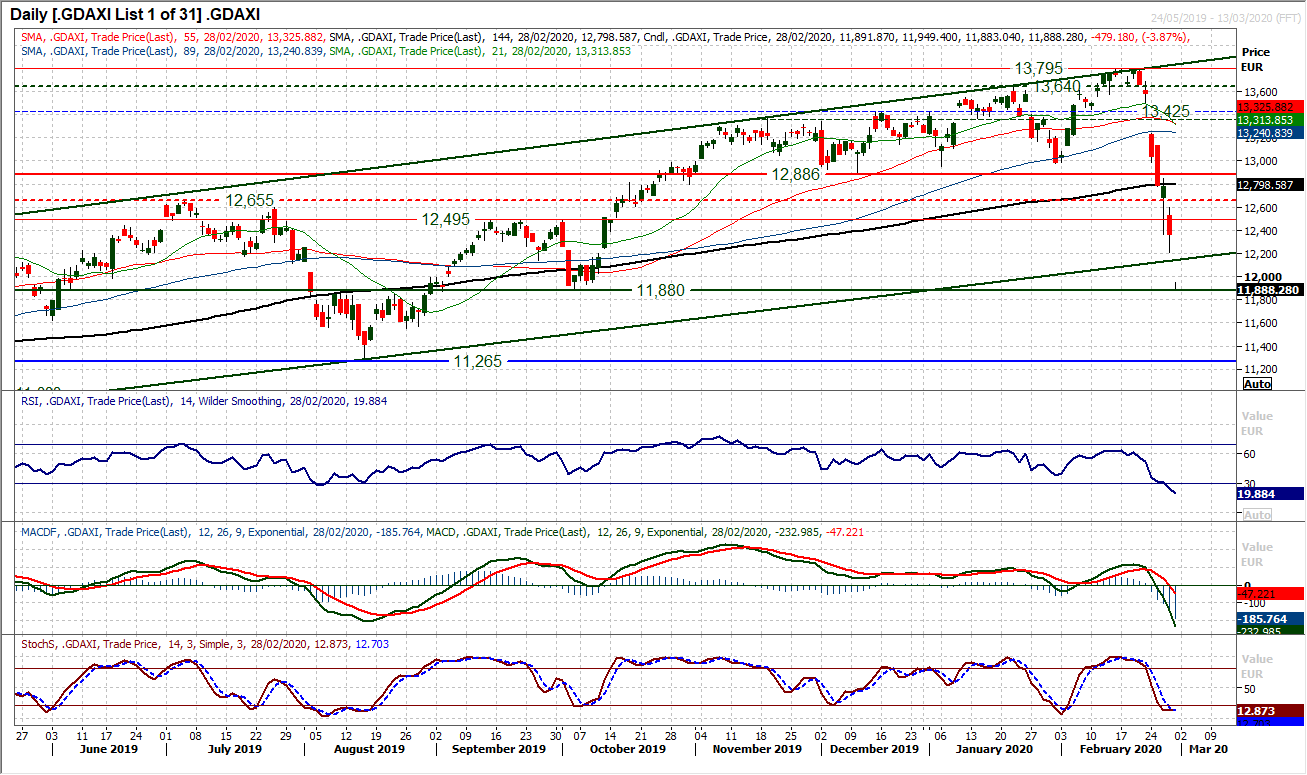

Chart of the Day – German DAX

With the DAX falling off a cliff (along with all other equity markets) in the past six sessions, it is an important time to see where the analysis sits. Dropping over -10% lower from the all-time high of 13,795 sees the DAX in official correction territory. Key support levels have been broken on the way but it is a move that is still just a retreat within a well-defined long term uptrend channel which comes in as a basis of support at 12,140 today. The RSI is well into oversold territory into the low 20s, but there is little reason to expect a sustainable rebound right now. Volatility on the DAX is understandably elevated right now, with the Average True Range of 228 ticks at six month highs, whilst the market closed well below the 2.0 SD Bollinger Bands yesterday. However, the market is getting smashed again early today and the channel is breaking now. The focus will be on the September low of 11,880 which marks a significant long term pivot level and is key support now. A breach would bring the August 2019 low of 11,265 into play, and this is a crucial support. The bulls need just to stem the tide of selling, even small losses would be a bonus right now.

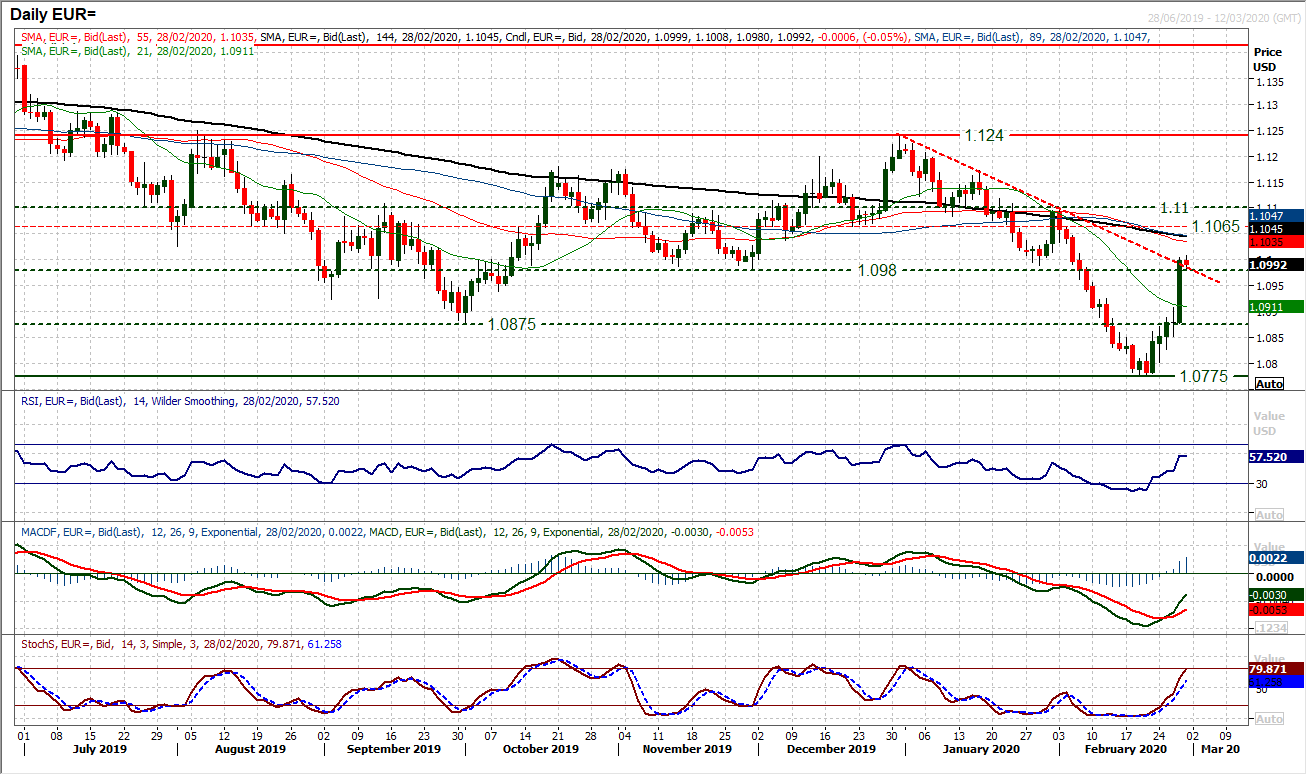

EUR/USD

The euro was already engaging a technical recovery, but the gains seen in yesterday’s session would have surprised even the more positive of traders. Adding +118 pips on the session was the biggest one day rise on EUR/USD since January 2019. The technical rally accelerated through key resistance at $1.0980 and also broke an eight week downtrend. With RSI into the high-50s, MACD and Stochastics accelerating higher, the bulls are in control, for now. However, we would caution backing against the dollar for too long here. The sell-off on the dollar is similar to the sell-off on the yen last week, a move which quickly unwound. We have been seeing a technical rally on EUR/USD as counter-trend and a move which is likely to be short term in duration. The move has gone further than we anticipated, but technically, the outlook is still corrective on a medium term basis. Old resistance is at $1.1065/$1.1100 with falling moving averages overhead. A move above $1.1100 which is a lower high, would change the outlook, but this is still likely to be a short term rebound that hits the buffers once more. Initial support at $1.0965.

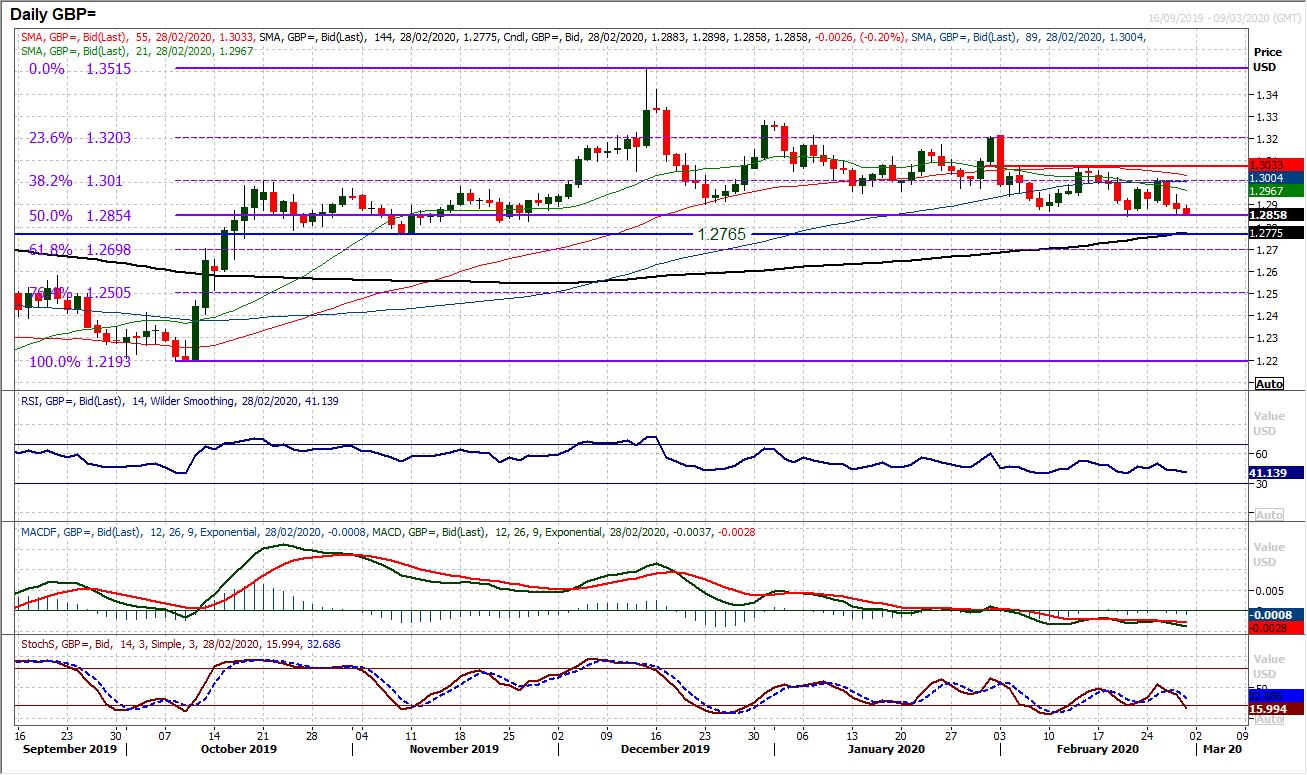

GBP/USD

The dollar was smashed across the majors yesterday, but the fact that Cable fell on the day just goes to show that sterling is under growing pressure now. Testing the support at $1.2845 is coming and with the momentum indicators sitting with a negative bias, the selling pressure is mounting. Another lower low below $1.2845 would be a third key time this has been seen since December and the medium term sellers are gradually putting the squeeze on. The next support level is at $1.2820, however, the key level that needs to be watched comes in at $1.2765 which is the November low. Furthermore, closing decisively below the 50% Fibonacci retracement (of $1.2193/$1.3515) at $1.2850 would open the 61.8% Fib around $1.2700. The downside levels are becoming more realistic now. With the lower highs in place, rallies are being sold into. Resistance at $1.3015 is increasingly important, with yesterday’s high of $1.2945 initially the barrier today.

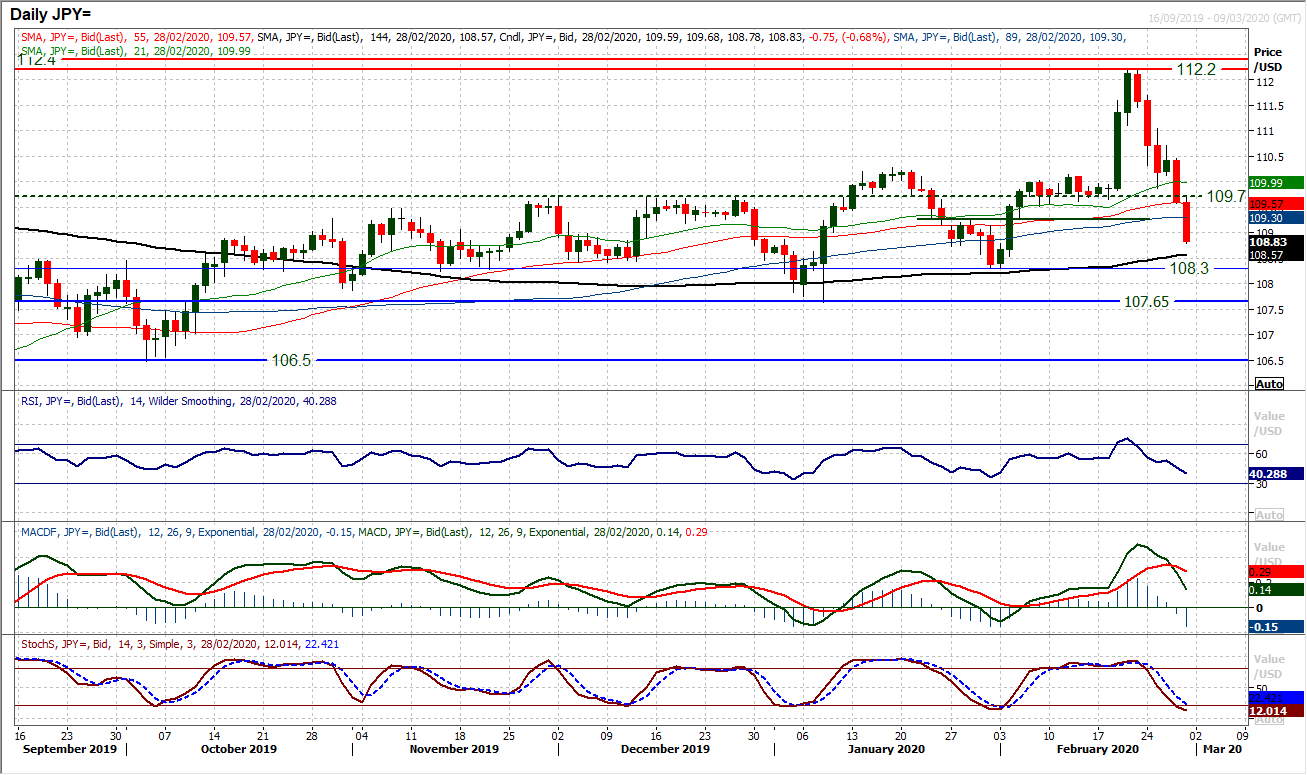

USD/JPY

The safety of the yen is the place to be right now as the dollar continues to see corrective pressure. This is dragging Dollar/Yen sharply lower and the move is breaking key near term supports to eye a test of key medium term levels. The volatility on the pair continues to climb, with the Average True Range at 74 pips around a six month high. A renewed bearish candle yesterday and further losses early today is breaching support at 109.50 to now open the February low at 108.30. The key level to watch now is at 107.65 which is the 2020 low and a breach would mark a decisive end to the dollar positive medium term outlook. Near term momentum is clearly negative right now, with sell signals through MACD and Stochastics, whilst RSI has further downside potential in the run lower too. Resistance is now in the band 109.25/109.70.

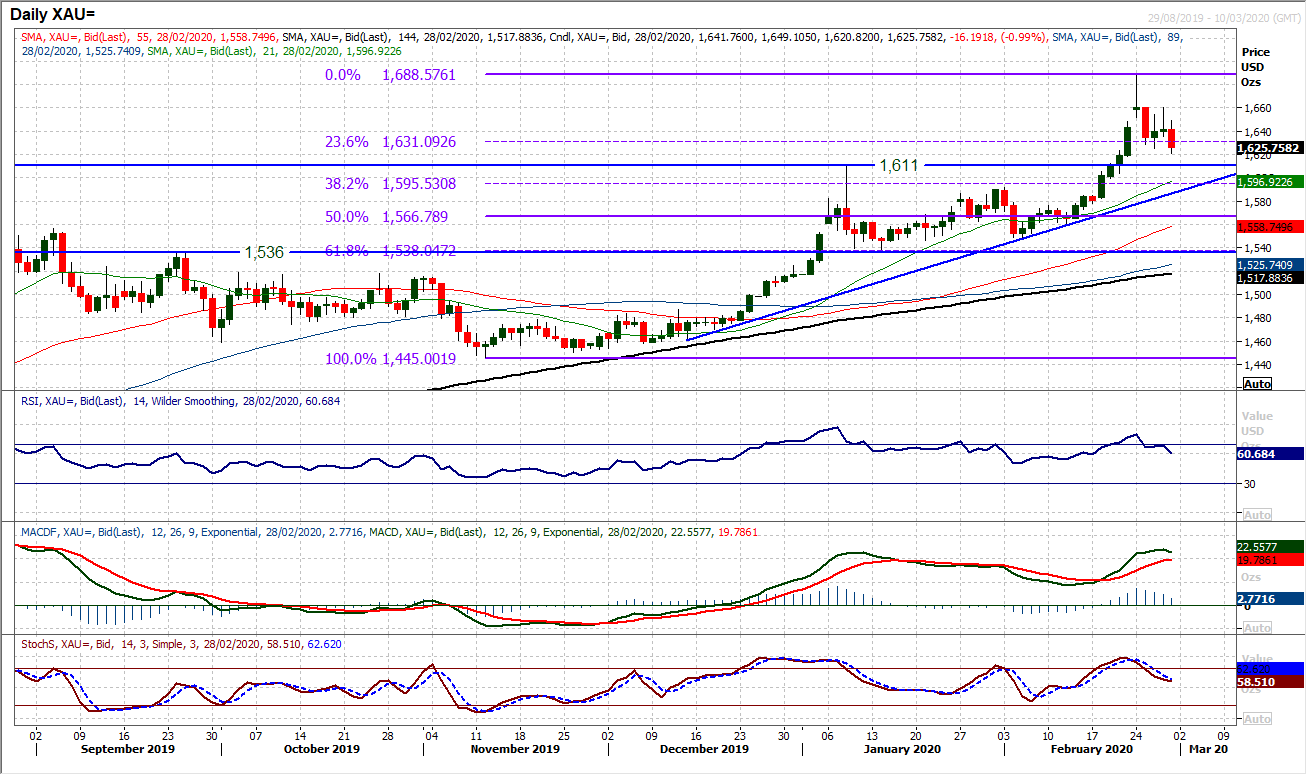

Gold

There are a few quandaries facing gold right now. Why is gold not rallying during this massive risk sell-off? Why is gold not rallying whilst the dollar is selling off? The momentum of the gold bull run played out last week, moving well into overbought territory on RSI. Since then the market has been unwinding. The reaction during yesterday’s session, where gold turned back from $1660, just shows that the bulls have run out of steam and profit-taking has hit again. The consolidation we talked about yesterday is beginning to break support as yesterday’s low at $1625 is being tested. Given the lack of bull reaction yesterday, the potential that there could be further unwind on gold is growing. The market is again testing below the 23.6% Fibonacci retracement (of the $1445/$1688 bull run) at $1632 as a basis of support. However, a close below $1625 would open a retreat to the last key breakout at $1611 and potentially the 38.2% Fib at $1595. Our expectation is that weakness on gold will build support in the coming sessions, allowing the upside potential to renew on gold. However, we also see that these are very volatility market conditions right now, but weakness as a chance to buy. The 11 week uptrend support is at $1587 today. Initial resistance at $1649 this morning.

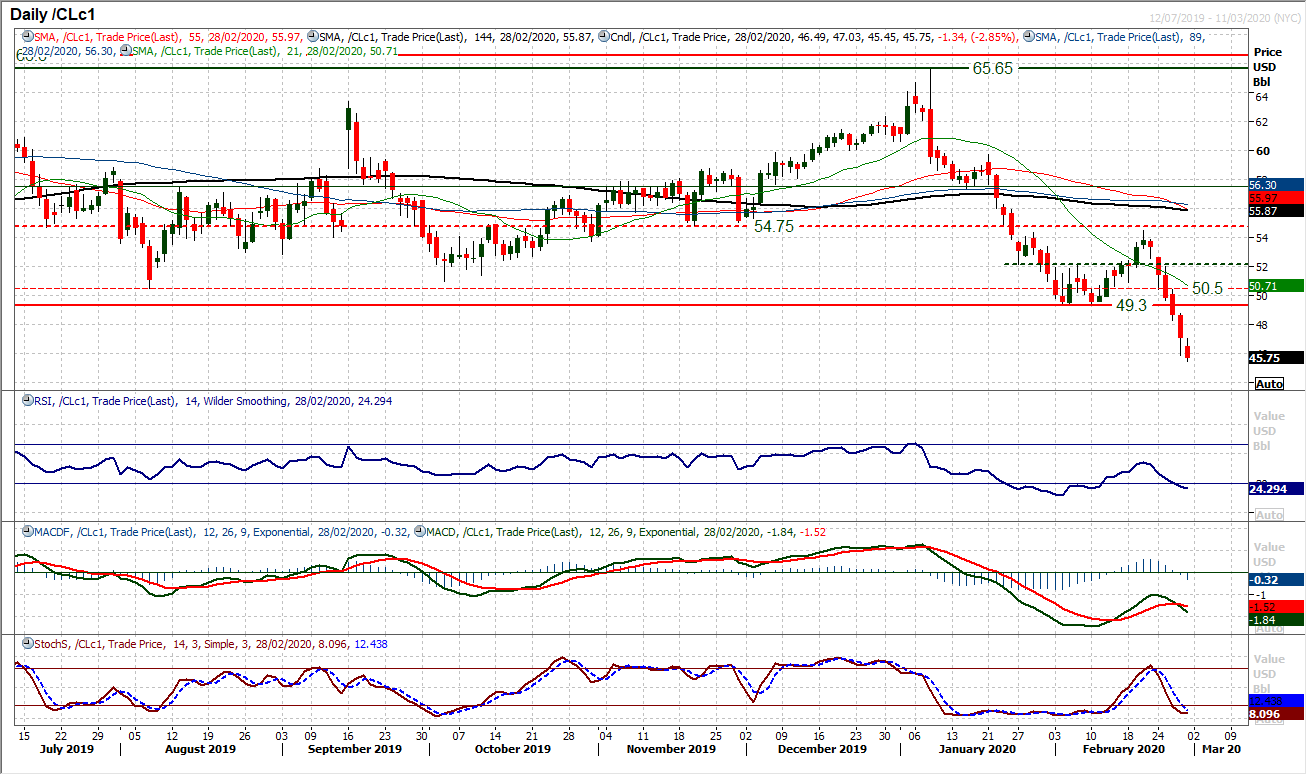

WTI Oil

The oil price continues to be smashed. Day after day the selling pressure is hitting the market and having traded decisively clear below $49.30 the market is now eyeing the crucial December 2018 low of $42.35. Momentum indicators are bearish but also show further downside potential still. Once more this morning, the selling pressure is hitting the market. Intraday rallies are being seen though, but these are just unwinding moves before the next wave of selling. The hourly RSI around 40/50 is a zone of opportunity for the bears now. Initial resistance at $45.90/$47.00. It needs a rebound above $47.75 for the bulls to even contemplate the potential for a rally of substance.

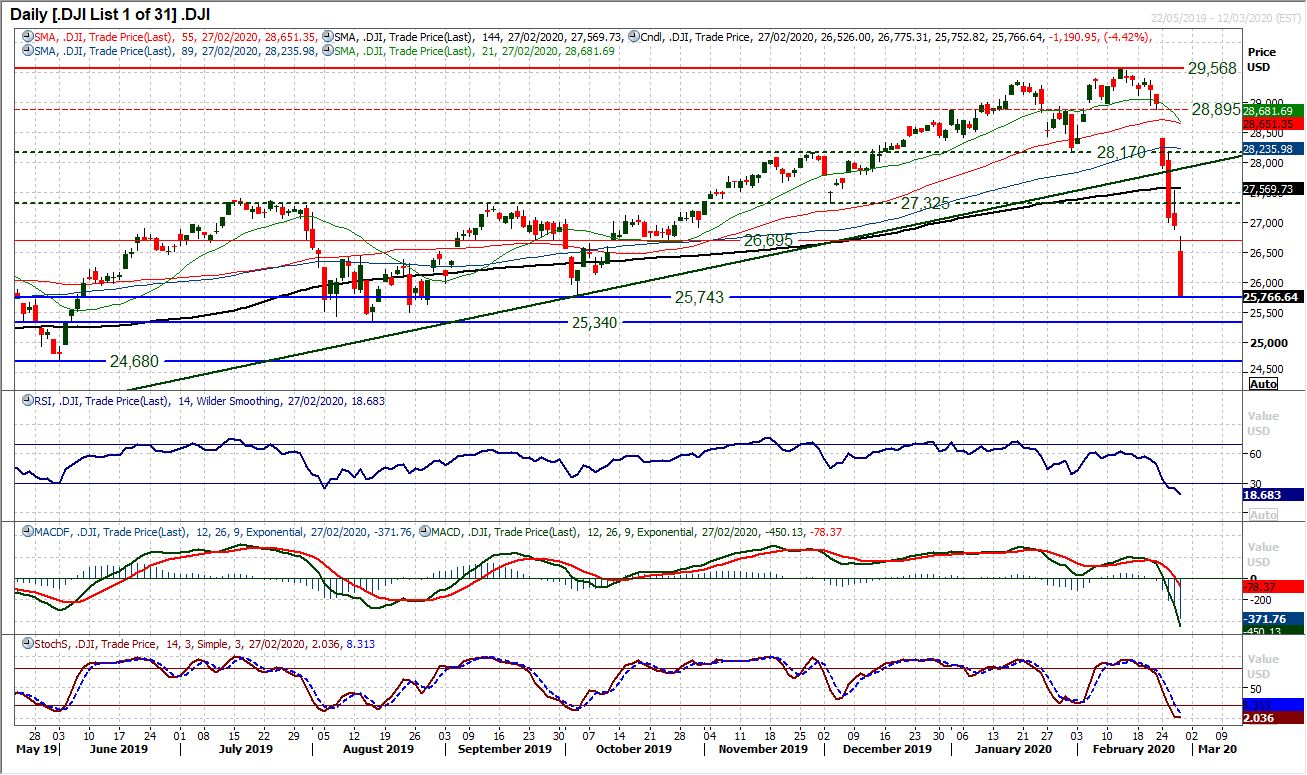

Dow Jones Industrial Average

Falling another 1190 ticks yesterday, the Dow had its biggest one day decline since October 2008, where markets were in the teeth of the great financial crisis. Volatility is huge, with traders and investors selling what they can right now. The market has fallen through several major support levels in the past week and closed last night around the key October low of 25,743. The problem is that futures are pointing to another 1% to 2% decline at the open today, meaning that the key August low of 25,340 will be directly challenged early today. However, seeing as some major support levels have mattered little this week, the momentum of the selling pressure is just smashing through anything in its path. The RSI is around 18 today, with MACD and Stochastics very bearishly configured. This is very much reaching extreme territory though now. The Dow is trading way below its 2.0 SD Bollinger Bands, whilst volume in yesterday’s sell-off was at a 14 month high. It is difficult to know where the sell-off might end, but around the open today (if futures are anything to go by) the decline will be in the region of -14% in the two weeks since the all time high. That is extreme and contrarians will be taking note.