Market Overview

So the COVID-19 outbreak is now an official pandemic according to the WHO. This suggests the virus is global and rampant in its spread. Countries are trying monetary and fiscal responses but whilst the Coronavirus spread accelerates with an unknown impact on major global economies and supply chains, then investor fear will remain elevated. The latest leg lower has been given further fuel overnight, with a scatter-gun approach address by President Trump that pointed the finger at other countries and provided little confidence that a coherent plan was in place. A 30 day flight ban from countries in the Schengen area of Europe, has been announced, but proposals elsewhere are not concrete, such as a potential payrolls tax suspension and $50bn of additional loans to small businesses. These proposals need to be approved by Congress. This is a time for decisive action to reassure markets. Traders seem unimpressed with how the Government of the largest economy in the world is set to tackle the crisis, with the situation set to be distinctly politicised by a polarised Congress. US futures fell during and after the address and traders come into today’s session with a bleak outlook. US Treasury yields have fallen back once more this morning, with the US 10 year yield -10bps from yesterday’s close and there is an associated hit to risk assets. As the European session has built up, the selling pressure is enormous, with equities over -6% lower. Safe haven forex (yen and Swissy) are the places to be, whilst higher risk commodity currencies (Canadian and Australian dollars) are getting hit. It is also interesting to see that the dollar is beginning to perform better. The question for today’s session, amidst the wave of new sell orders is how the ECB will approach the situation? The ECB has been increasingly mindful of the negative impact of its unconventional measures. If this is a “whatever it takes moment”, what can the ECB really do to create a support building shock and awe reaction. A small cut to the deposit rate? Increase QE? Targeted TLTROs? Adjusting the tiering system? None of these would be considered shock and awe.

Wall Street fell into the close with another record sell-off on the Dow, losing over -1400 ticks. The S&P 500 closed -4.9% lower at 2741, with US futures another -5% down. Asian markets were hit with the Nikkei -4.4% and Shanghai Composite -1.5% (becoming an interesting outperformer). European indices are over -6% lower. Forex majors show a safe haven (JPY, CHF) positive, versus higher beta (CAD, AUD) negative bias. In commodities, gold is retracing some of yesterday’s losses, whilst oil is accelerating lower again, currently down over -5%.

After the emergency BoE rate cut yesterday, focus will be on the ECB decision today on the economic calendar. However, first up the Eurozone Industrial Production at 1000BST which is expected to show an improvement in the month of January by +1.4% which would improve the decline to -3.1% year on year (from -4.1% in December). The US PPI is at 1230GMT and is expected to show headline PPI for February falling to +1.8% (from +2.1% in January) whilst core PPI is expected to remain at +1.7% (+1.7% in January). Weekly Jobless Claims at 1330GMT are expected to increase slightly to 218,000 (from 216,000 last week). The ECB monetary policy rates decision is at 1245GMT and consensus expects the ECB to refrain from any move on the deposit rate from -0.50%, or the main refinancing rate from zero. ECB President Christine Lagarde’s press conference at 1330GMT could be a spicy affair, given the moves of other banks recently.

Aside from ECB’s Lagarde, there are no other central bankers due to speak today, with FOMC members in the blackout period until next Wednesday’s meeting.

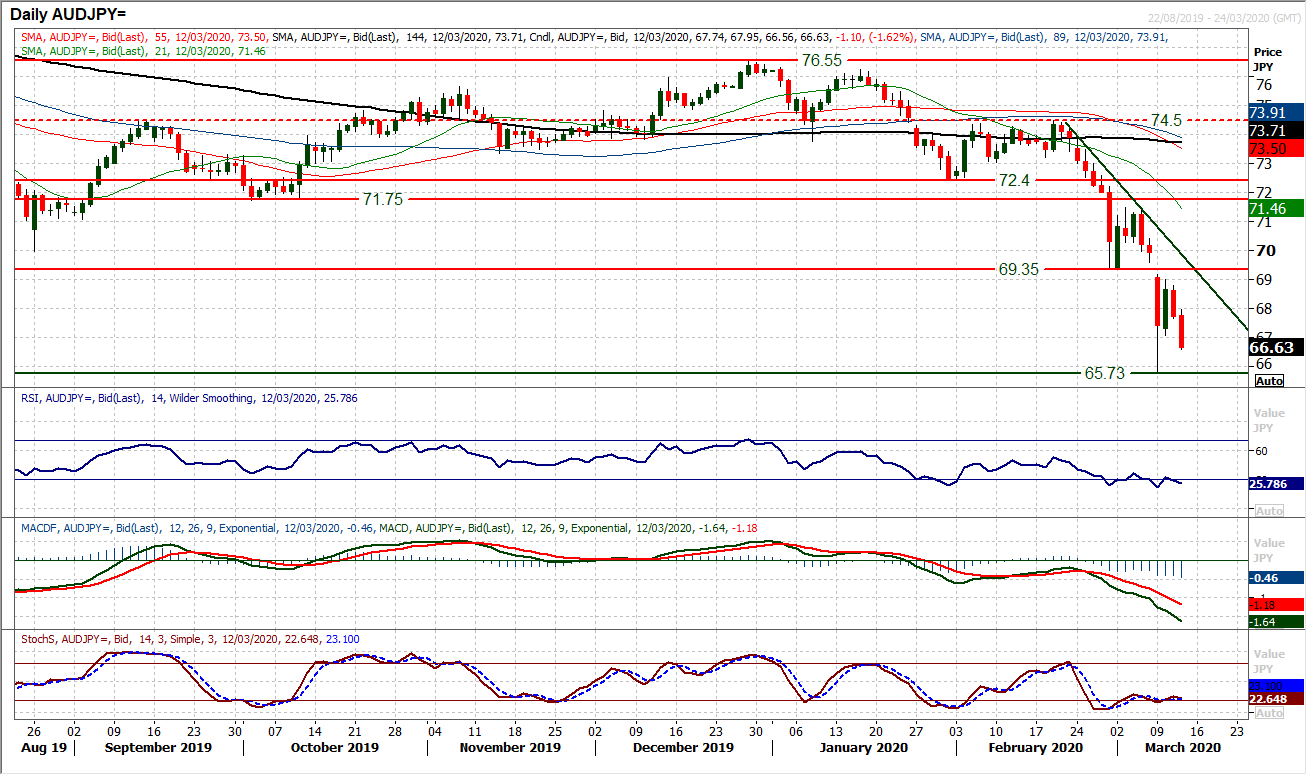

Chart of the Day – AUD/JPY

With the massive dichotomy of performance across forex majors (safe havens versus high beta) there have been some huge moves and extended volatility. But what are we looking for as signals for a recovery. On AUD/JPY there was a key breakdown from 69.35 support whilst there is a capitulation gap at 69.58 that remains unfilled. However, a choppy market through the first half of the week is now resolving lower once more. The gap remains unfilled (“closing” a capitulation gap would have been a positive signal that the bulls are on the comeback trail) and early selling pressure is kicking in again. Momentum indicators remain negatively configured and near term rallies remain a chance to sell. There is a hint of positive divergence on Stochastics, but RSI and MACD lines are deteriorating again and this is not a knife to be caught right now. A retest of Monday’s low at 65.75 has to be the base case right now. A technical recovery needs a push above resistance 68.75/69.00. The three week downtrend at 69.90 today which is also a gauge to watch. Initial resistance 67.65.

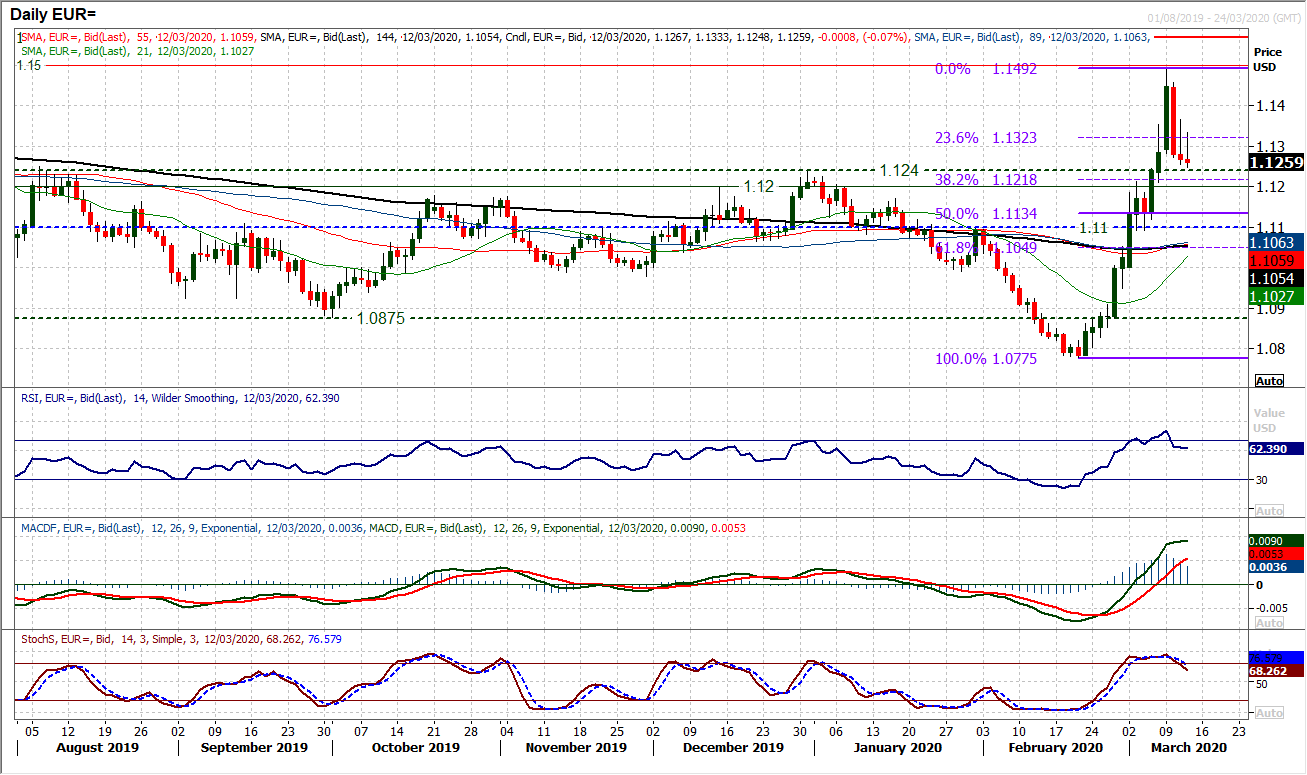

EUR/USD

The intraday volatility continues and a renewed sense of the dollar regaining lost ground is pushing through. After Tuesday’s decisive strong bear candle, an intraday failure at $1.1365 before EUR/USD fell hard in the US session and the retracement is gathering momentum. With two decisive closes below the 23.6% Fibonacci retracement (of $1.0775/$1.1492) around $1.1325, the way is open towards 38.2% Fib at $1.1220. The old breakout highs of $1.1200/$1.1240 where old resistance becomes new support, are now a realistic pullback zone. It seems increasingly that intraday rallies are becoming a chance to sell. Subsequently, it will be interesting to see how the bulls respond today. Already a move towards the 23.6% Fib has again attracted sellers again this morning, in a move similar to yesterday’s session. Momentum indicators are rolling over, with a sell signal bear cross on Stochastics now present. With rallies increasingly fading, a retreat towards the 38.2% Fib is likely now, with a close under $1.1200 being the next corrective signal. The ECB will add in an extra layer of volatility today too.

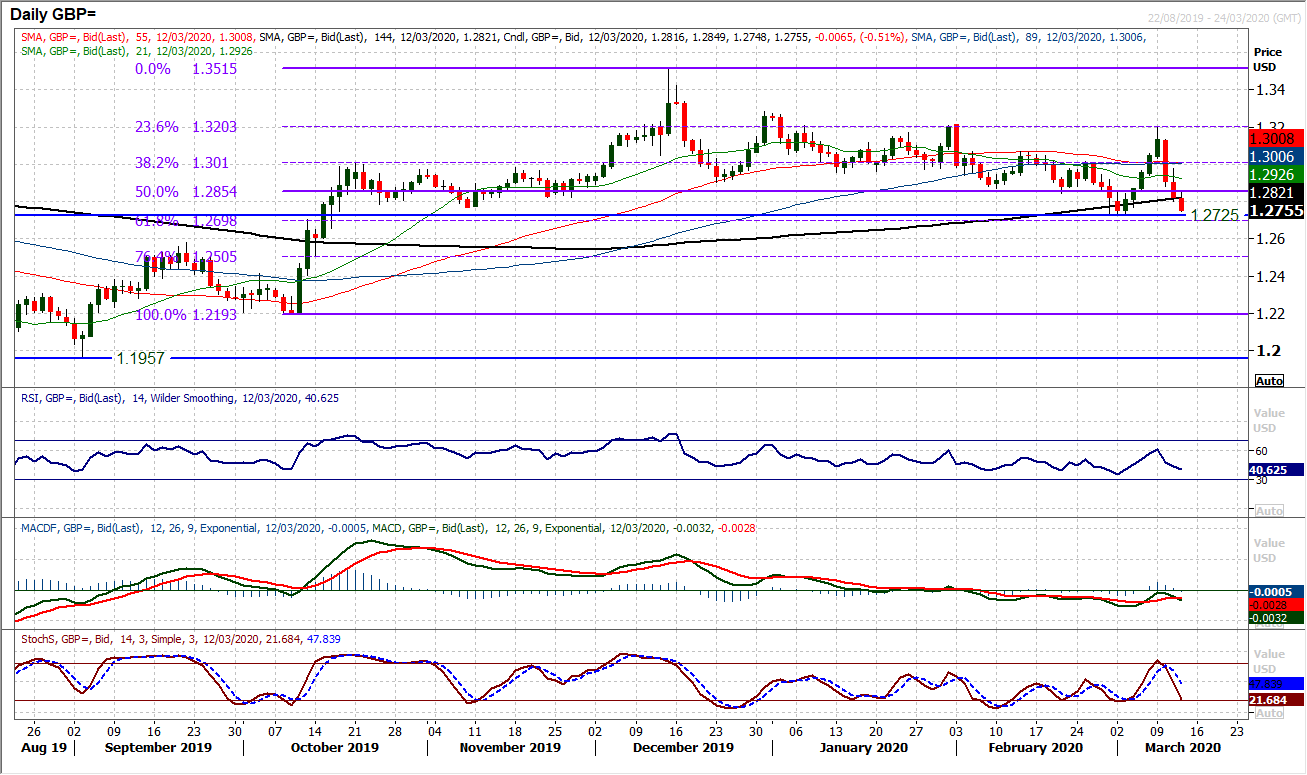

GBP/USD

A huge day for UK fundamentals of monetary and fiscal policy, but the sterling reaction was fairly benign. It was the stronger dollar that is impacting through Cable right now. On a technical basis, there is a corrective bias forming within the range again, with two decisively negative candlesticks eyeing the support of the medium term range again at $1.2725. We continue to see the Fibonacci retracements (of $1.2193/$1.3515) as being key near term signals and turning points. So the move below the 50% Fib at $1.2855 was key last night and has once more become a basis of resistance for today’s session. With RSI consistently failing at 60 and subsequently retreating into the mid-30s in recent weeks, there is downside potential in this move as RSI sits around 40. Also, MACD lines are turning over under neutral and Stochastics bear crossed, intraday rallies are a chance to sell for moves towards the bottom of the range again. Yesterday’s reaction high at $1.2975 adds to resistance of the 38.2% Fib is a barrier to gains at $1.3010. Below $1.2725 opens $1.2500/$1.2580.

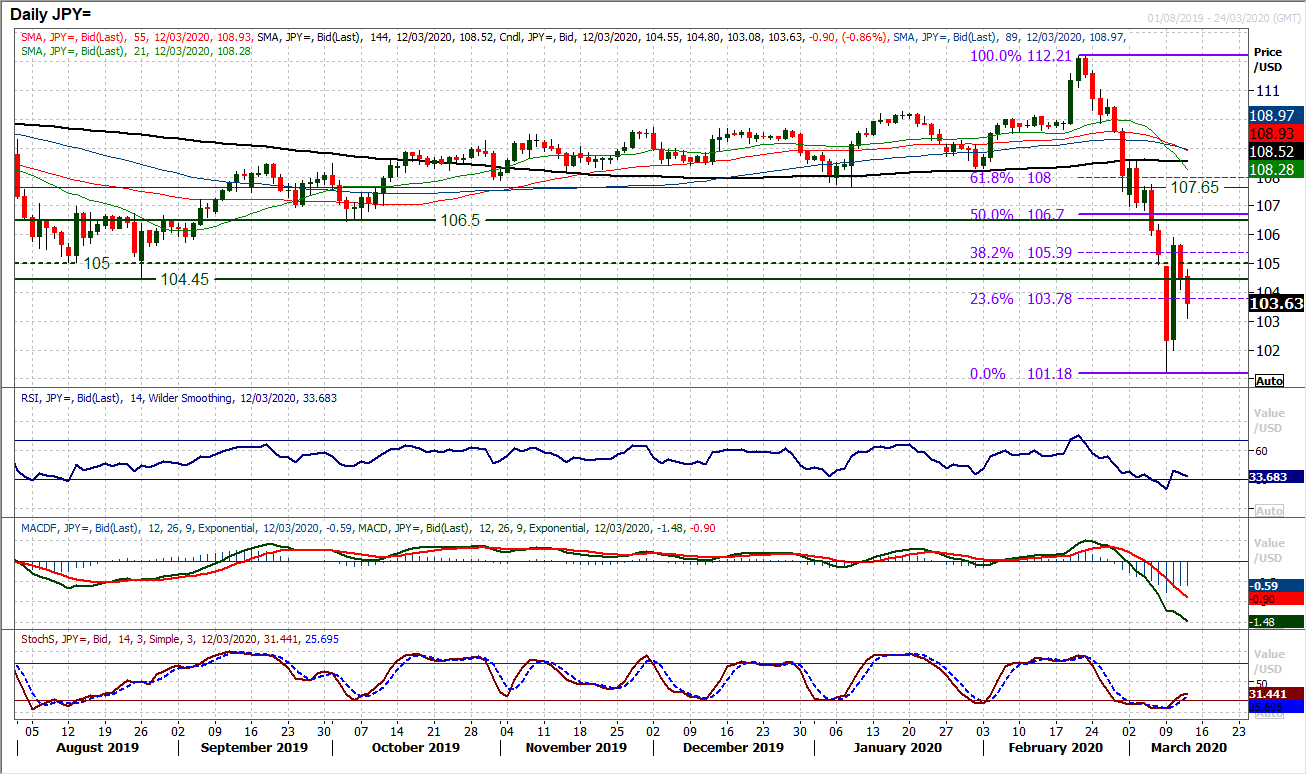

USD/JPY

Huge volatility continues to play out through Dollar/Yen. With an Average True Range of 176 pips already having been seen in the session even before the Europeans have had their morning coffee, the wild ride continues. It is interesting to see amidst the volatility, there are some signs of improvement on the technical. RSI and Stochastics are off their lows and the market is trading around the 23.6% Fibonacci retracement (of the 112.20/101.20 sell-off) around 103.80. This will become a gauge now for recovery. Pulling decisively below this Fib level effectively re-opens the lows again. The hourly chart shows a pivot around 103.00 which also needs to be watched as a basis of support. On the upside, the bulls need a move above 105.00/105.90 resistance band to suggest a sustainable recovery is building now.

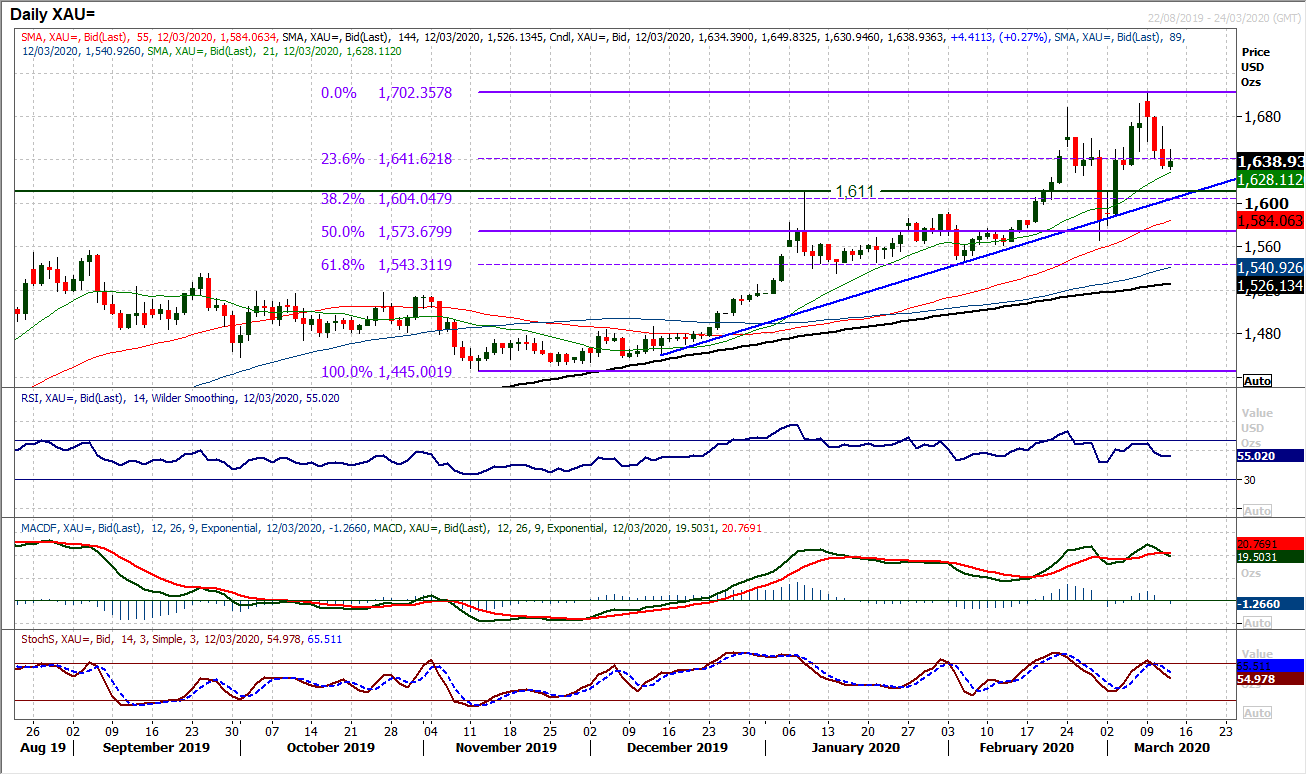

Gold

We have been seeing an increasing number of signals on gold pointing towards a technical correction. With the hourly chart topping out under $1660 on Tuesday, the prospect of a downside target towards $1620 has come into play. Trading clear below the 23.6% Fibonacci retracement (of the $1445/$1702 rally) at $1642 has now opened the way for the $1620 target now. Yesterday’s bull failure at $1670 has left another lower high and a third consecutive bear candle adds to the corrective outlook. The hourly chart shows with today’s initial rebound failure at $1650 there is a near term pivot becoming increasingly prevalent too. The daily chart shows momentum indicators are rolling over now and are increasingly reflective of a near term pullback within the bullish medium term outlook. A Stochastics bear cross is close to being replicated on MACD. The supports within the medium term bull trend are coming back into focus, the old key breakout of $1611. The support of a three month uptrend sits at $1604 today.

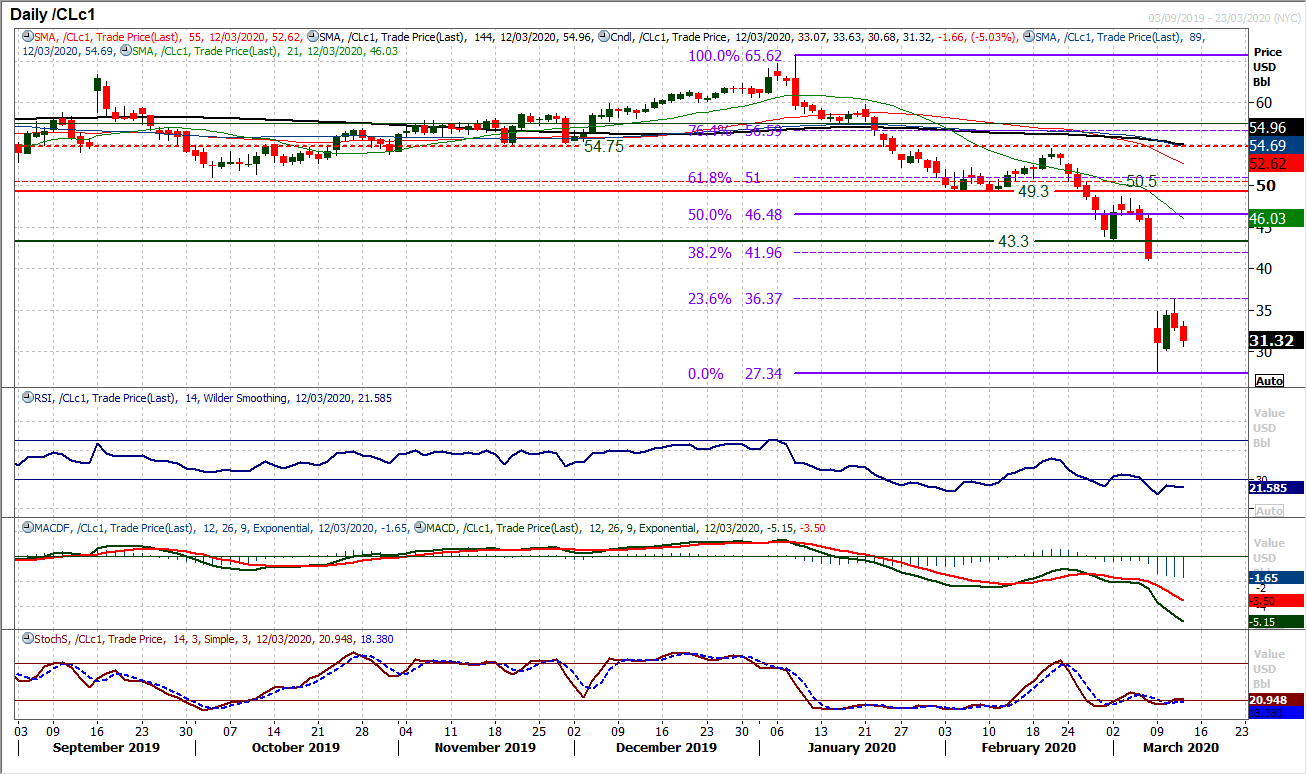

WTI Oil

With the market risk outlook taking a pummelling once more, the attempt at a recovery on WTI has fallen over. A rebound failed almost to the tick at the 23.6% Fibonacci retracement (of $65.60/$27.35) at $36.35. Yesterday’s decisive bear candle has been followed up by further selling pressure today. The hourly chart shows there was a key higher low in the recovery at $30.15 from Monday’s enormous rout of a session. If WTI falls back below here, then the $27.35 key low is back in focus. With consistently bearish momentum, intraday and near term rallies have to remain a chance to sell. Initial resistance around $33.75.

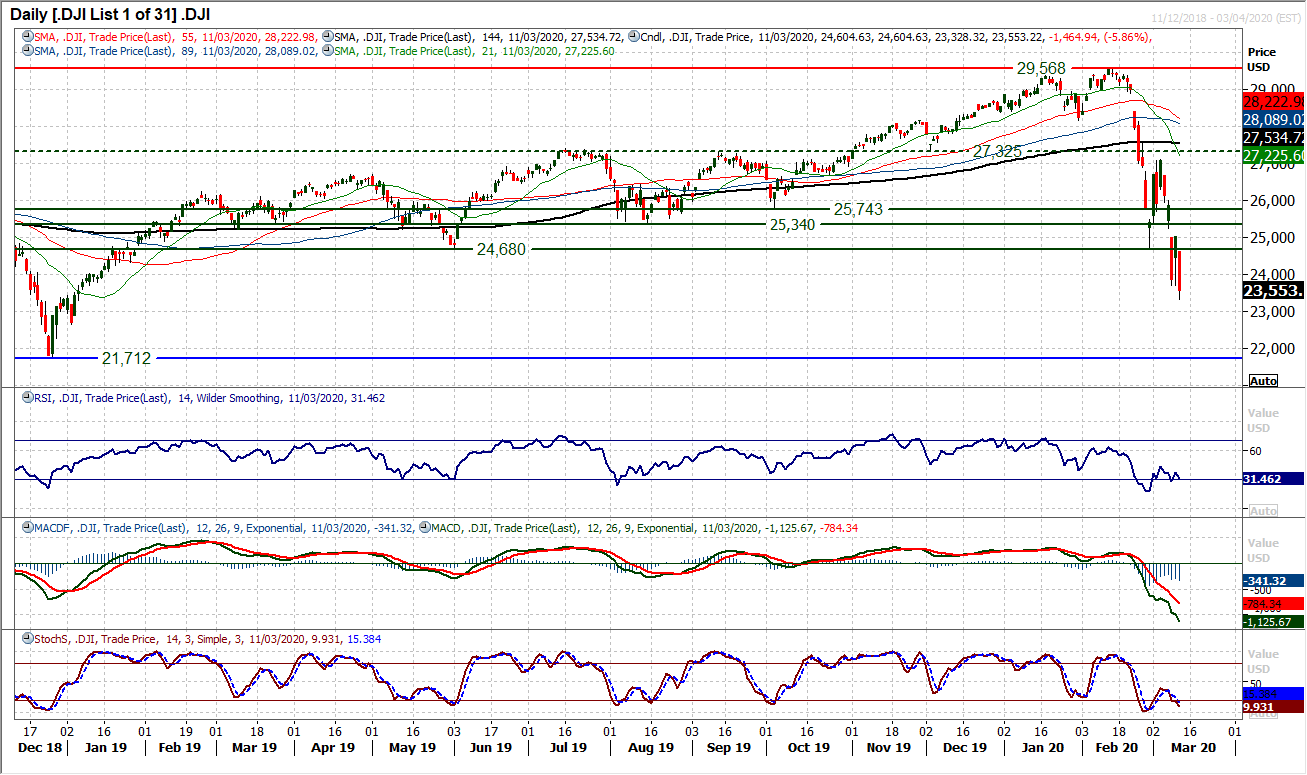

Dow Jones Industrial Average

The Dow had another enormous sell-off yesterday, breaching Monday’s low in a session of -5.9% decline. The market is back around levels of January 2019 again. The next minor support is around 22,640 but essentially the next key level is 21,710 which was the start of the huge 14 month bull run. Technicals are negative again and with RSI at 31 on the close last night further downside potential is there. US futures are another -4% lower early today and the selling pressure continues. The old low from Monday around 23,700 becomes a basis of resistance now.